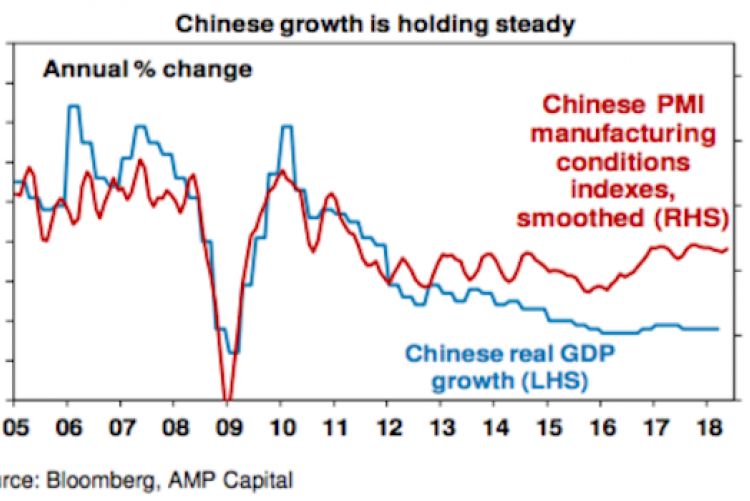

Chinese economic growth continues to be steady since 2016 at about 6.8%. Expect Chinese growth this year of around 6.5% and inflation of 2.5-3%. Key risks regarding China relate to the policy focus shifting to reducing leverage and reform, rapid debt growth, a trade war with the US and the property cycle.

We expect Chinese growth this year to slow a bit as investment slows further to around 6.5% and consumer inflation of 2-3%. Key risks facing China.

Second, China's rapid debt growth could turn sour.

This has been concentrated in corporate debt and to a lesser degree household debt and has been made easier by financial liberalisation and a lot of the growth has been outside the more regulated banking system in "Shadow banking".

An obvious concern is that when debt growth is rapid it results in a lot of lending that should not have happened that eventually goes bad. However, China's debt problems are different to most countries.

Chinese authorities have long been aware of the issue and growth in shadow banking and overall debt has slowed but slamming on the debt brakes without seeing stronger consumption makes no sense.

Ultimately, we desire a negotiated solution, however the risks are high and a full-blown trade war considering the US could knock 0.5% or so off Chinese short-term growth.

The Chinese Government has plenty of firepower to support growth though, so a "Hard landing" for Chinese growth remains unlikely for now.

Solid growth in China should simplify for keep commodity prices, Australia's terms of trade and export volume growth reasonably solid.

With strong assets supply, we are a long distance from the boom time issues of last decade and growth will probably have average around 2.5-3%. Rising US rates of interest in opposition to flat Australian rates implies more draw back when it comes to the $A, but solid asset prices ought to provide a floor for the $A in the high $US0.60s. Key implications for financiers Chinese shares remain reasonably great value coming from a long- term perspective, but pay attention their short-period volatility.

To read on the Shane Oliver's full report regarding China's economy click here.