- The Fed has exceeded all expectations around the quantum of its policy support. The corollary of its actions is positive for equities even if its generosity has stopped short (at this stage) of adding this asset class to its balance sheet.

- Monetary policy actions cannot change the speed at which containment policies are removed and this suggests periodic bouts of disappointment relating to the economy and health crisis will continue. But, the willingness to support low quality debt markets has positive flow on effects for other risk assets.

- Last week’s policy announcements change the narrative for equity markets from “selling into strength” to “buying on weakness”. But the consequence of a backdrop that has macro tailwinds, but micro headwinds means idiosyncratic risk will remain high for now. Investors still need to tiptoe through stock selection in order to avoid earnings and dividend downgrades as well as potential capital dilution.

There is a disconnect that has emerged between the economic outlook and the strength of equity markets - due in no large part to the unprecedented nature of the Fed’s policy actions. From the start of the crisis, one of our key messages was that policy makers might not get it right the first time, but once they showed commitment to the cause, in the end they would do whatever was necessary (See “Nature is no match for Liquidity”).

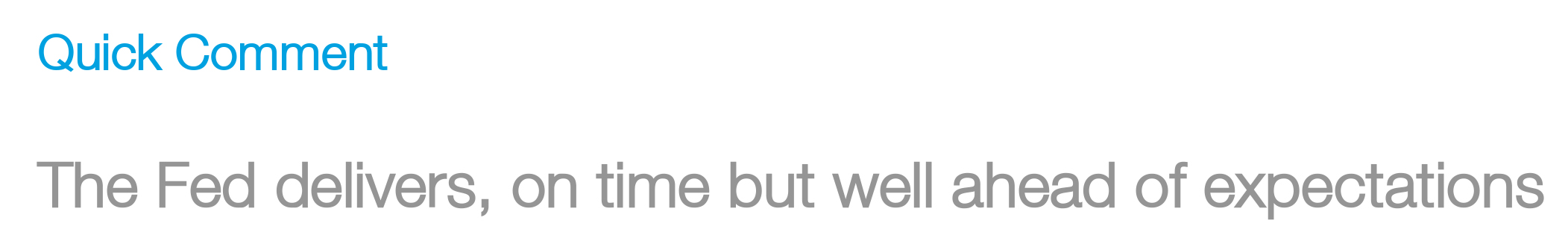

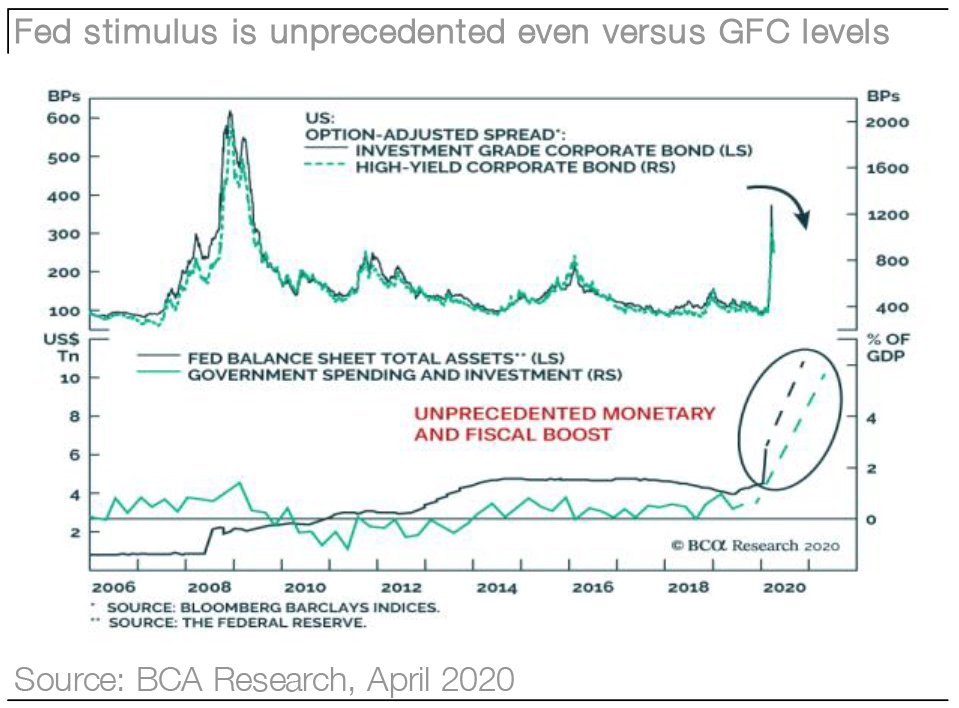

We believe the Fed has now surpassed all expectations on the size and breadth of its monetary policy initiatives following last week’s announcement of a further US$2.3tn support package for small businesses/municipalities and that it would begin to buy a broader selection of assets including high yield debt (to go with their existing purchases of investment grade debt and ETF’s).

In effect, the Fed is now a buyer of very nearly any debt with a distressed price. Anything it’s not buying, probably doesn’t need to be bought for economic or financial market stability reasons at this point in time. It is hard to even fathom the quantum of its commitment with estimates now suggesting its balance sheet could expand to more than $10tn by year end (a doubling in 10 months of what took 10 years post the GFC).

While monetary and fiscal policy have no part to play in determining when containment policies will be unwound (and the risk is that this is much slower than the V-shaped expectation built into consensus estimates), or prevent further defaults and bankruptcies from picking up, their actions will help drive further tightening in credit spreads, will ensure the discount rate remains capped and will help support corporate cashflows.

It’s doubtful the Fed’s actions will be sufficient to offset periodic bouts of concern around the economy or the health crisis, but the corollary is that they will further reduce financial market volatility (both bond and equity) and likely put a floor in the price risk assets. We think it also changes the narrative from “selling into strength” to “buying on weakness”. In the end, this will leave the Fed as a major creditor for large swaths of US debt at the very time when the quality of debt is deteriorating, but the size and what’s left on its balance sheet is now a worry for another day.

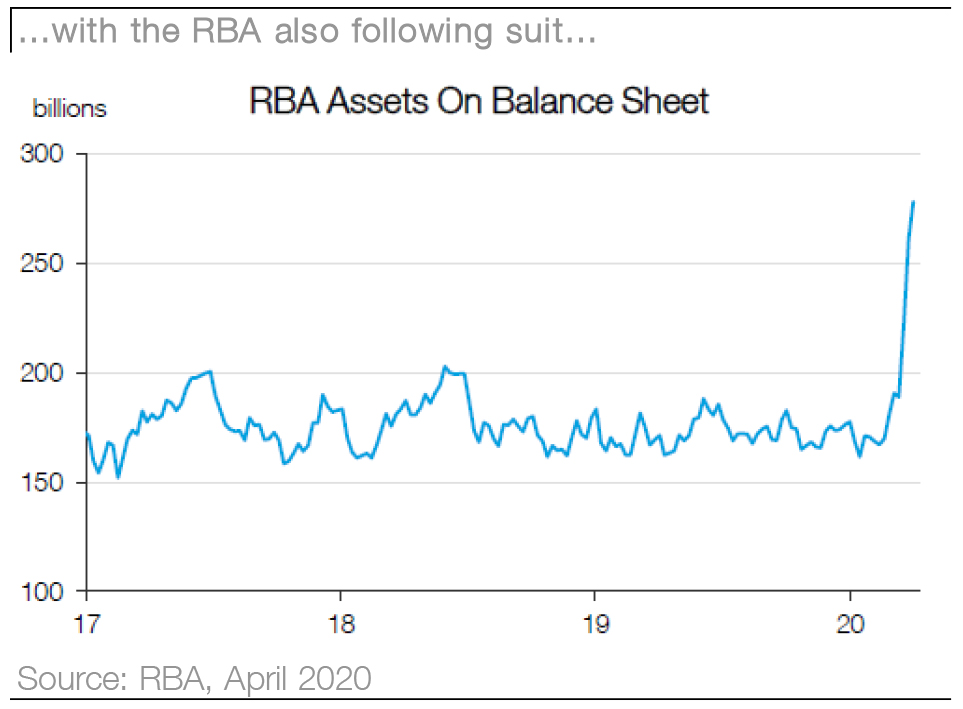

We don’t think equities are necessarily ahead of themselves to have priced in a more optimistic backdrop. There is now a clear sight line on peak infection rates in global hot spots (i.e. NYC and Italy) as well as for Australia and the immense level of monetary and fiscal stimulus is surprising even the bulls. As long as investors understand that there will be periods of disappointment ahead as both the global and domestic economy plumb unprecedented lows and as the corporate profit cycle is revised substantially lower.

There will be a long tail of woes related to (potential) corporate and consumer defaults and delinquencies, but these are normal and part and parcel of economic downturns (let’s not forget we have a deep one coming). In addition, the rush to tap additional capital will continue as corporates shore up their balance sheets but Australian corporates are not facing a balance sheet crisis and so we are not concerned that the market is rewarding rather than punishing those that are opportunistic enough to tap markets for additional cash.

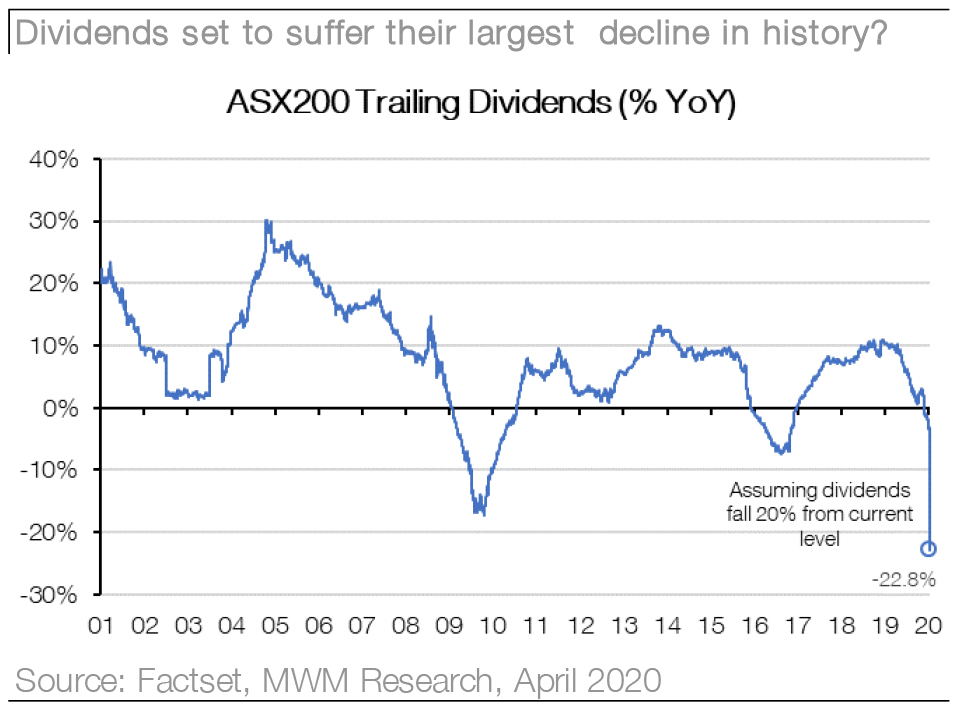

The consequence of a backdrop that has macro tailwinds, but micro headwinds means idiosyncratic risk will be high in the coming months. Investors need to tiptoe through stock selection in order to avoid earnings and dividend downgrades as well as potential capital dilution (see “Quick Comment: Stock selection in the embrace of a bear market”). We are not concerned that bottom up analyst estimates look grossly optimistic given the size of the economic hit coming.

As we set out in our markers for a sustainable bottom, the market will be on a path to recovery well before earnings estimates trough. In addition, the scale of policy support means that the trend in revisions might be even less relevant than is normally the case particularly as corporates are choosing not to provide earnings guidance.

Ultimately, we think the constraints for the Australian equity market will not come from global developments. We believe they will come from domestic conditions around the post COVID-19 strength of the economy, the profit and dividend growth outlook and what is a “fair” price for the market.

These will be issues we address in our next piece including the relative outlook for Australian versus Global (US) equities.

For now, the Fed has removed further doubt that markets need to revisit or push through late March lows. If the recession proves short, then equities are not overly optimistic to have rebounded. But any outcome other than this will keep voalitlity high. Similarly, the economy is not the same just because it rebounds. Any cracks before COVID-19 will be there post COVID-19 and then some. Last, the equity market was expensive, lacked earnings growth and was on an unsustainable payout ratio prior to the sell-off.

No matter how much stimulus is thrown at the crisis, these issues must be revolved once COVID-19 concerns disappear. It isn’t a stretch to think earnings growth will be lower, payout ratios will be lower and valuations (at least for growth stocks) will be lower. This could well mean that after the sugar rush of unprecedented policy stimulus, we simply go back to what it was like before...only not quite as good.

Jason and the Investment Strategy Team

_______________________________________________________________________________________________________________