The lockdowns associated with the COVID-19 pandemic have caused a sharp slowdown in global growth. For most businesses navigating this environment, the immediate focus is on financial survival with sustainability taking a back seat, albeit we believe temporarily.

As we move past the survival phase, those companies that have the financial capacity are likely to demonstrate an increased focus on their social responsibility credentials.

For some, this response will be voluntary in an effort to raise the greater good. For others, it may be less voluntary, as they perform national duties in areas that are strategically important or have economy-wide implications.

The crisis is also drawing government into taking a greater role in the economy in several ways, including the willingness to provide unprecedented financial support for business through loans, grants and potentially ownership stakes. In addition, the fallout from the pandemic may also prove a catalyst for governments to direct increased fiscal stimulus towards social and environmentally important areas such as healthcare (i.e. hospitals) and med-tech as well as indirectly as a result of a focus on economic growth via increased “green” infrastructure spending.

We see two ESG themes emerging in a post COVID-19 world:

- A developing expectation that businesses prioritise social responsibility over excess profits - The Social category in ESG, covering “softer” issues like employee diversity, has historically lacked focus from investors in part due to the difficulty in quantifying and measuring this factor versus Environmental and Governance. Now the human impact of this crisis has left the focus very much on social issues such as employee health and safety, working conditions and cost management through layoffs.

- A change in societal demand for certain products and services – This emerging demand is providing businesses the opportunity to thrive through offering beneficial and sustainably focussed solutions to problems arising from the pandemic. The demand is coming across three areas:

- Consumer: Changing behaviours like working from home and social distancing are encouraging rapid take up of new communications technology.

- Business: Onshoring and de-risking of supply chains is creating a need for efficiency gains and providing the opportunity to incorporate environmentally friendly sourcing and processes.

- Government: Government demand for technology to manage social distancing and public health.

How is the pandemic impacting ESG issues?

The pandemic is highlighting the increasing importance of Social – The “S” factor is proving most acute through issues such as worker health, workforce conditions and greater visibility of business support of the community.

The Social issues are impacting businesses in both direct and indirect ways. Some of the more direct financial implications are the costs of dealing with worker health and safety and adapting to new flexible working arrangements like work from home and associated online support.

Other less direct impacts include risks like requiring staff to commute to work or be face to face with members of the public as part of their role. There is also a growing visibility of business choices when handling issues like staff layoffs and perhaps accepting government financial support and subsequent capital management.

Consumers continue to align with brands whose values they share. The failure of supply chains, particularly in the area of critical medical supplies, has seen businesses like LVMHs perfume division and alcohol giant Pernod Ricard repurposing production lines to produce hand sanitiser that was in short supply. These are more isolated examples but highlight that companies seeking to do the right thing and give back to the community increase the likelihood of strong customer support.

Governance will influence a company’s ability to adapt and respond to the crisis – Governance also is coming under the spotlight. Companies with more effective board structures and composition should be positioned to successfully navigate the challenges raised by the pandemic. The crisis could provide insight into how well a company has instilled the necessary values to balance the sometimes-conflicting needs of all stakeholders.

Environmental implications are indirect for most companies – The initial environmental impact is being seen through issues like the improved environmental performance of companies through a temporary reduction in energy demand and business travel. Waste production might also be lower but within this medical and hazardous waste will rise and use of single use plastics in supermarkets and health services has also spiked.

Some businesses may need to defer environmental commitments due to liquidity limitations, making emissions targets more difficult to achieve. Regulatory influence may also have an effect, perhaps with environmental targets being relaxed or timelines extended. The pandemic is providing the catalyst for business and government to work in a more coordinated fashion in support of “Green” infrastructure such as renewable energy projects. This support can also come from the removal of red tape, enabling streamlined siting and construction of renewable energy projects.

What are the implications for ESG investing going forward?

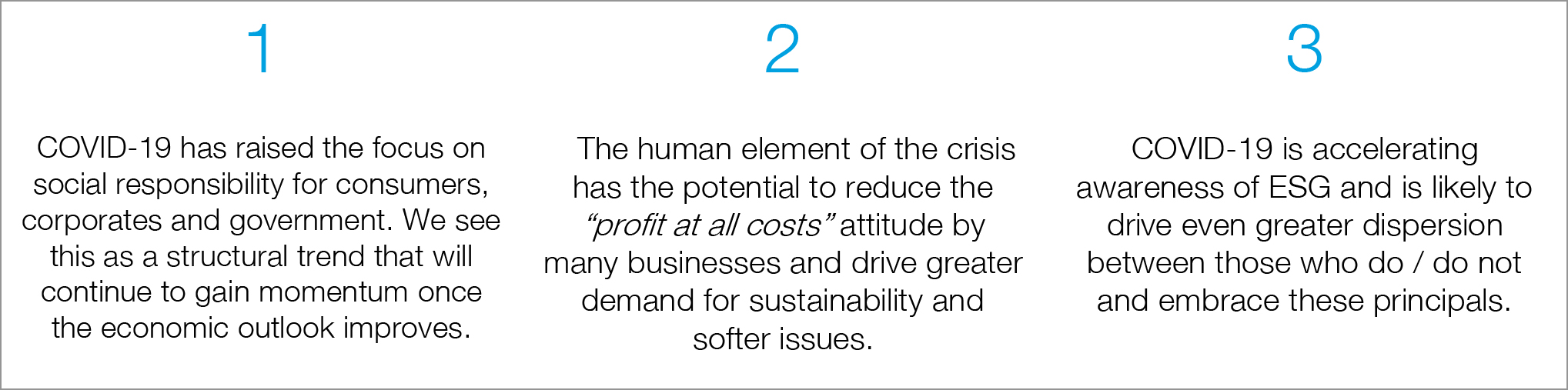

- The pandemic crisis is lifting interest in and awareness of ESG investing at every level. Social factors such as employee health & safety, job security and social responsibility have taken on a higher level of importance and visibility during the pandemic and look to be long-lasting.

- The crisis will speed up the rate at which companies are incorporating sustainability into their dealings with all stakeholders. We expect this may well lead to a structural increase in direct and indirect costs through issues like the health and safety of staff, increased regulation and the reputational benefits of improved environmental performance. However, in time we would also expect to see some offset via channels such as improving staff productivity and/or the cost of financing (vis-à-vis those who are less willing to adopt ESG principals).

- The crisis will raise the risk premium applied to those businesses not responding to the crisis in a sustainable manner. Risks of this type would include decreased customer demand for products and services, and higher employee costs due to reduced loyalty and therefore higher turnover.

Conclusions

The coronavirus has been highly disruptive to global businesses, and the subsequent fight for financial survival has meant sustainable investing is taking a temporary back seat. However, as finances improve and a gradual recovery takes shape, the social implications from the crisis should see increased demand and investor interest in businesses that are able to place a greater emphasis on social responsibility. We believe this crisis is likely to elevate ESG in investors’ minds, continuing a structural shift where ESG investing is no longer a trade-off of returns against values.

Jason and the Investment Strategy Team

________________________________________________________________________________________________________________________________