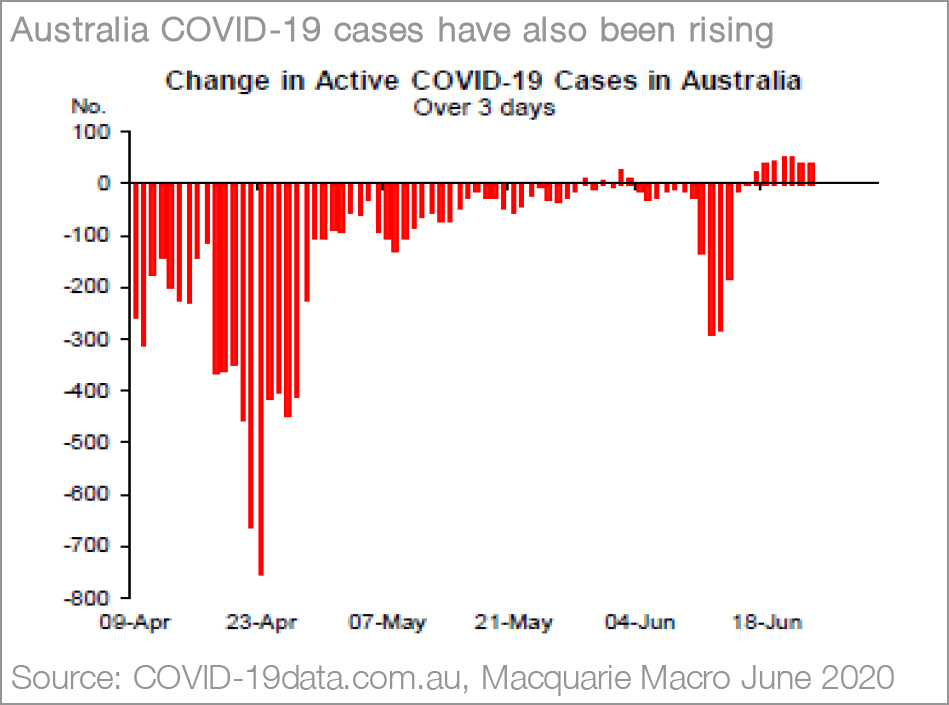

- Without a COVID-19 vaccine, the relaxation of social containment policies always had the potential to drive a fresh wave of infections. This risk is now emerging.

- It is unlikely that governments will revert to the most stringent of prior social containment measures given the publics apparent lack of tolerance for the reintroduction of such measures (despite personal risks).

- How policy makers react to a potential slowdown in the economic recovery will be crucial for determining the near-term direction of financial markets. At this stage, the recovery is not at threat but the pace could slow if infection rates continue to climb.

- Rising uncertainty will drive further risk asset volatility, but if financial conditions remain “ultraeasy” and economic activity and corporate profits continue on a path back to trend, then the cyclical outlook for equities remains higher. We stick to with our equity overweight while remaining well diversified as a hedge against elevated volatility.

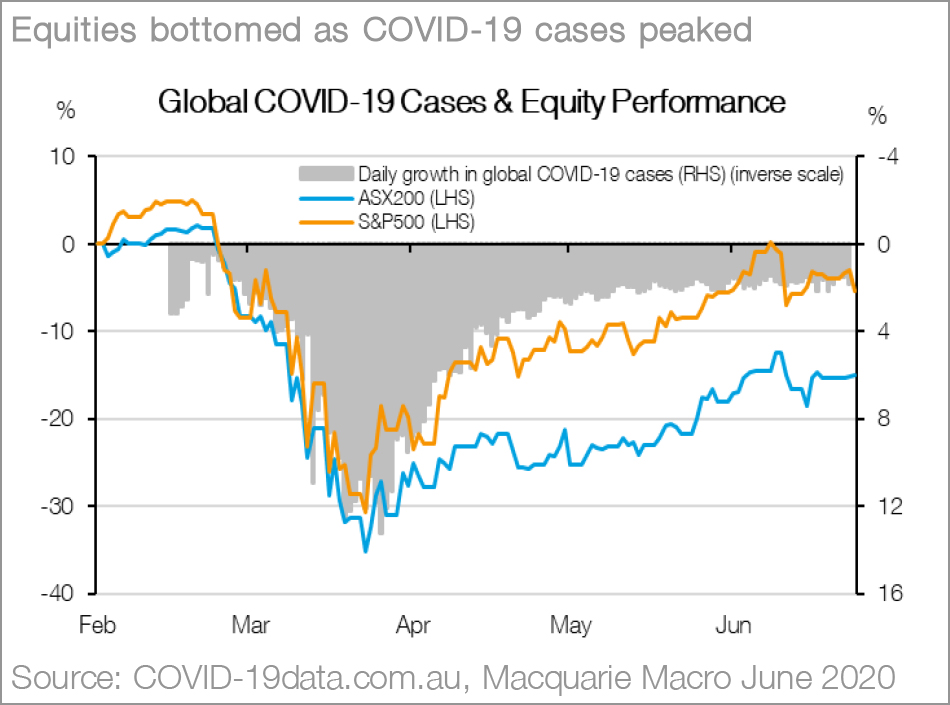

The rally in equity markets has been closely linked to a bottoming of infection rates and the reopening of economies. The size and pace of the rebound can, inlarge part, be attributed to an unwinding of overlypessimistic growth expectations alongside an openended commitment by policy makers to support liquidity requirements of consumers, business and financial systems.

This combination of policy supports works well for risk assets when it goes hand in hand with an improvement in economic activity. However, it becomes less effective if enforced or voluntary social containment begins to restrain the resumption of activity or causes uncertainty around potential policy responses – as is now a rising risk.

At this stage, we have not altered our thinking in terms of how governments will respond to further outbreaks of the virus, but we admit that this situation is fluid and will depend on how widespread these new infection outbreaks become as well as how policy makers respond.

Consequently, we believe the economic impact of rising infection rates within the developed world has the potential to slow the pace of the recovery rather than to put it at risk. Similarly, we think rising uncertainty will provide a strong reason for governments to avoid a “fiscal” cliff by removing policy support for consumers and business before the economic recovery becomes more self-sustaining.

Admittedly there are some large assumptions underpinning this view.

If lock-down fatigue prevents governments from applying more stringent social containment measures, will the public voluntarily protect themselves for the sake of enjoying the fruits of normality? Will governments be pragmatic around when they remove policy supports if economic activity has stagnated? And will central banks maintain their (almost) zero tolerance for financial market volatility and avoid a negative feedback loop from developing? For the most part, we think yes.

While our outlook for the world and markets mightappear rosy, there are some important reminders from recent developments.

- There are numerous risks that have the potential to keep investors on edge particularly when coming off the back of a substantial rally in equity markets. Against this backdrop, we think investors should remain hedged against downside but not positioned for this as a central case. Clearly the pace of gains across equity markets is unsustainable but the drivers for further cyclical improvement remain in place even if the path higher is uneven and this underpins an overweight equities vs defensive assets call;

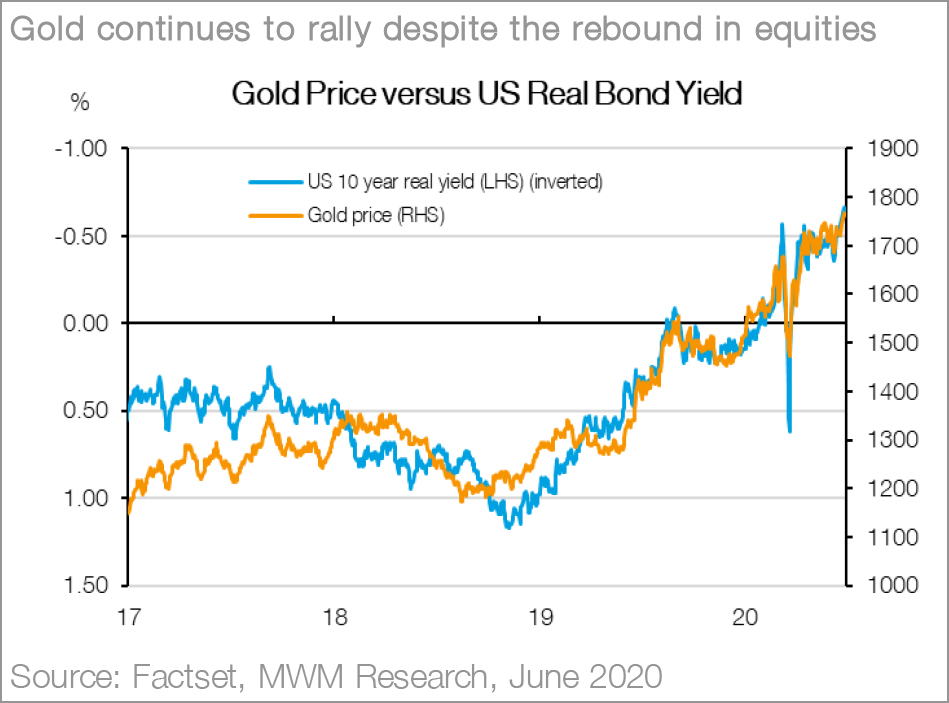

- A rise in infection rates was always a risk in the absence of a vaccine. We think this signals a continuation of elevated volatility in financial markets which investors must be comfortable absorbing if they are to maintain growth asset exposure (i.e. last nights 2.6% decline in the S&P500 was only the 16th largest of the year!). But, uncertainty around the pace of the recovery will keep bond yields anchored and central banks ready to limit downside risks;

- Through a combination of large income transfers and spending restrictions, household cash balances have exploded (in Australia they have risen to nearly 5x the average level seen over the past decade). While precautionary concerns will keep cash balances elevated, they provide further fuel for risk assets should risk tolerance stabilise and/or fall;

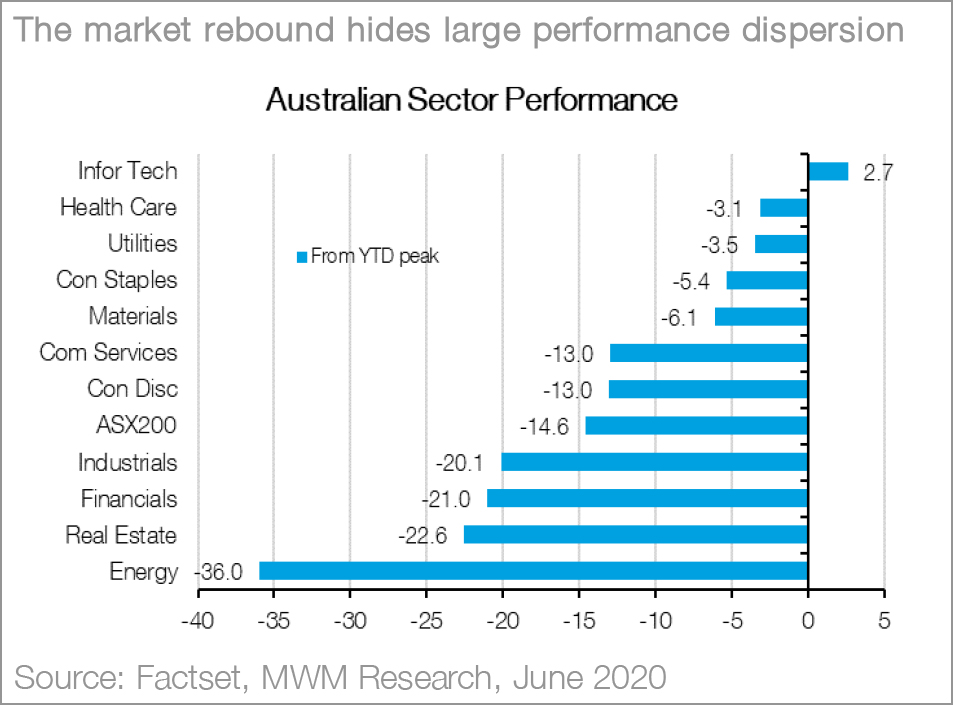

- Equities are susceptible to swings in sentiment but fears of a disconnect with economic reality are overplayed. Global equity markets have been driven by a re-rating in areas of technology that are structural beneficiaries of a COVID-19 world. Areas that remain impacted by COVID-19 remain well off prior highs. There is optimism in markets, but the differentiation amongst winners and losers is clearly evident. We see further upside for value stocks but this will be limited by the strength of the economic recovery (earnings rebound) once the valuation normalization is over.

Uncertainty is part and parcel of economic and financial market recoveries. The strength of the recovery in equities does not mean growth follows a similar path. Cyclical upside underpins our overweight position in equity markets, but we are not prepared to be overweight growth assets and underweight defensive assets which would imply aligning all our positions on one outcome. We think remaining diversified is key to navigating the outlook through 2020.

Jason and the Investment Strategy Team

_______________________________________________________________________________________________________________