The last few weeks have seen political developments (primarily China related) come back into focus for with the start of the National People’s Congress, rising tensions in Hong Kong and a deteriorating US-China relationship. This has seen political uncertainty rise at a time when growth risks are already high. We analyse some of the key Chinese political developments and their implications for investors.

National People’s Congress - No growth target set, no problem…

China’s virus-delayed National People’s Congress in Beijing began on 22nd May. This gathering of the country’s highest legislative body (usually held for two weeks in March, although due to COVID-19, held for just one week this year) is to confirm/refine the Party’s existing objectives on key issues. This year, a post-virus recovery is its central theme.

Premier Li opened the ‘Two Sessions’ by listing 2020’s major macro targets with the most notable being the absence of a 2020 GDP growth target. This is unusual but Premier Li mentioned high uncertainties from the Coronavirus and the global economy as the primary reasons. That said, it is not a signal that Beijing doesn’t care about economic growth as it provided targets for other key variables including employment. We think it reflects the high degree of uncertainty around the backdrop and that they are more focused on the inputs to growth rather than the output.

- Commentary out of the NPC has been in line with Macquarie’s expectation that it would not be the vehicle for signalling stimulus escalation.

- The gradual easing trajectory is set to continue for the rest of the year with Li calling for further rate cuts and for ‘notably higher’ credit growth in 2020.

- Macquarie expects a big lift in economic stimulus later in the year when economic conditions are likely to soften again.

Hong Kong comes back into focus

On Friday Asia markets sold off, led by a sharp 5.6% decline in the Hang Seng Index, its biggest daily fall since July 2015. The turbulence was set off by a proposed new National Security Law for Hong Kong bypassing the usual lawmaking process in Hong Kong’s Legislative Council, which has raised concerns on the city's autonomy, and therefore its status as a financial hub.

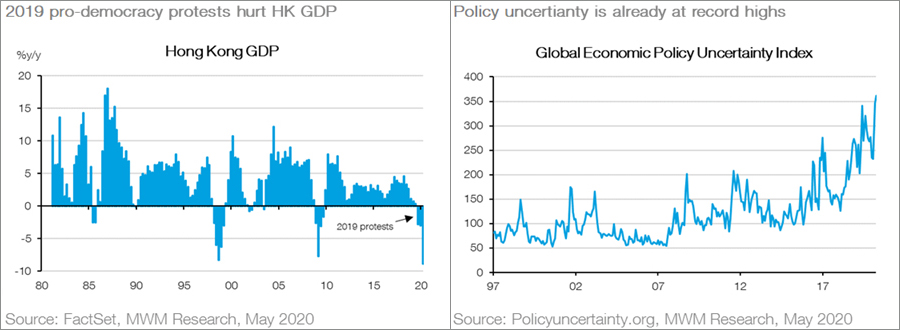

The concerns over the National Security Law are compounded by two issues. First, as the Hong Kong lockdown ends, this security law may spark a return to the violent street protests that Hong Kong endured in late 2019 that had a substantial impact on economic growth; and second, any measures taken by China that are seen to be in contravention of Hong Kong’s autonomy will raise the ire of the US Congress, which under certain circumstances, could remove favourable treatment for Hong Kong trade.

- The potential for a resumption of pro-democracy protests is again rising. These proved to be extremely disruptive to HK economic growth through 2019 and would come at a time when it is recovering from COVID-19.

- Fears of a loss of HK autonomy give the US another area to leverage in its anti-Chinese rhetoric which has risen in recent weeks. A sustained rise in political uncertainty could begin to undermine the upward momentum in risk assets.

US-China tensions are escalating

Anti-China sentiment is rising in the United States, in part reflecting China’s role as the origin of COVID-19 but potentially as a diversion tactic for President Trump given concerns around the US administration’s handling of COVID-19. With nothing to lose, there is a major risk that if President Trump’s poll numbers deteriorate, his incentive to escalate tensions with China correspondingly rise.

The proposed National Security Law for Hong Kong has already raised the ire of US Congress. Additionally, last week the US also moved to thwart Chinese telco Huawei from acquiring semiconductors from foreign manufacturers.

At this stage, and despite rising tensions, both US and Chinese officials have been quoted as pressing ahead with the Phase 1 trade deal agreement. Top White House economic advisor Larry Kudlow last week said the U.S.-China Phase 1 trade deal is "intact" and does not need to be renegotiated.

US-China tensions have spilled over to Australia, given Australia’s role as a key US ally. Australia had been at the forefront of a push for an inquiry into the origins of COVID-19. Recently China has suspended imports from four large red meat abattoirs, slapped an 80 per cent tax on all barley grain imported from Australia and announced ‘new supervision rules’ on iron ore imports from 1st June. There were also reports that the Chinese government had begun warning state-owned power utilities not to buy new cargoes of Australian thermal coal and to purchase domestic coal instead.

- The US President is unpredictable and the degree of his hostility towards China is likely to be related to his poll numbers. But, while China relies on the West, the West still relies on China.

- The World has entered a more chaotic and less predictable phase, but Macquarie think change will be a process rather than a cliff, albeit with some chance of extreme outcomes. Markets will again learn to live with heightened political uncertainty.

- Australia is in a tight spot. The desire to diversify its export base is not matched by the ability to do so in the near term and it is now caught up in US-China tensions. But China’s resource constraints suggest its policy responses may have more bark than broad economic bite.

Investment conclusions

- Political uncertainty is rising at a time when the global growth backdrop is fragile and risk assets are pricing in an optimistic economic recovery. Recent developments may already signal the death knell for the US-China ‘Phase 1’ trade deal.

- During 4Q18, equity markets suffered a significant sell-off as a result of rising US-China trade tensions in combination with overly restrictive monetary conditions. Global growth fundamentals are now meaningfully weaker, but liquidity conditions are meaningfully stronger. Rising trade tensions have potential to halt the liquidity driven risk rally.

- China is still some way from implementing “Stage III” stimulus which would provide a strong tailwind for commodity prices and by association the equity market. In the meantime, Macquarie think iron ore, met coal and LNG all lack viable alternatives so appear safe from an escalating dispute but thermal coal looks to be an easy target as Australia is not a key source of supply.

- • The outlook for iron ore remains solid. Flagship price signals are remarkably stable, and volatility has collapsed. Not even China’s massive steel inventory, built during the virus hit of 1Q20, has rattled short-term ore/steel conversion activity with Brazil supply hamstrung by an extension of its wet season and the deteriorating COVID-19 situation in the country.

Jason and the Investment Strategy Team

_______________________________________________________________________________________________________________