- We don’t think bond yields have reached a level that puts the economic recovery or equity market rally at risk.

- There is no magic bond yield level that consistently tips the equity market over. Sustained equity market weakness is likely to require a combination of factors including a reversal of central bank policy and deteriorating economic fundamentals.

- At this stage, there is a strong reflationary pulse behind the rise in bond yields. Macroeconomic surprises remain positive and corporate fundamentals are improving quickly even if valuations are extreme in some areas.

- We remain committed to the reflationary trade. Historically equities have outperformed bonds during cyclical rebounds even in the initial stages where bond yields are rising. Consequently, we remain overweight equities and underweight bonds.

Our next Investment Strategy Update will outline how we are investing for rising bond yields within the equity market

There is an enormous focus on the recent rise in long bond yields and if/when they may start to undermine – even prick – the equity bull market. We do not pretend to know the bond yield level that will prove to be a tipping point for equities because in reality there is no magical level that moves the outlook from good to bad (on a consistent basis) as this is as much about the conditions that surround the move in the bond yield as it is about the level of the bond yield.

This does not mean we can ignore a rising bond yield until it reaches a (potential) tipping point range. If the bond yield does go higher, then it should be met with a sliding scale for decreasing exposure to rate sensitive areas, which is a relatively simple and incremental approach to de-risking/hedging against rising rates. Without getting overly technical, we provide some general thoughts on how investors should think about the trends that are unfolding and help avoid being completely caught out if we do reach a tipping point in bond yields.

As a starting point, we think investors should avoid tying their investment outcomes to a “level” of the bond yield. Instead, the focus should be on a number of factors which would signal a more sustained shift in the fundamental backdrop for cyclical versus defensive assets. This includes: 1) the speed at which bond yields are rising; 2) the driver of higher yields (improving growth and/or rising inflation); 3) the signal from policy makers that accompanies rising rates; and 4) the direction of fundamentals. We discuss our stance in these factors below:

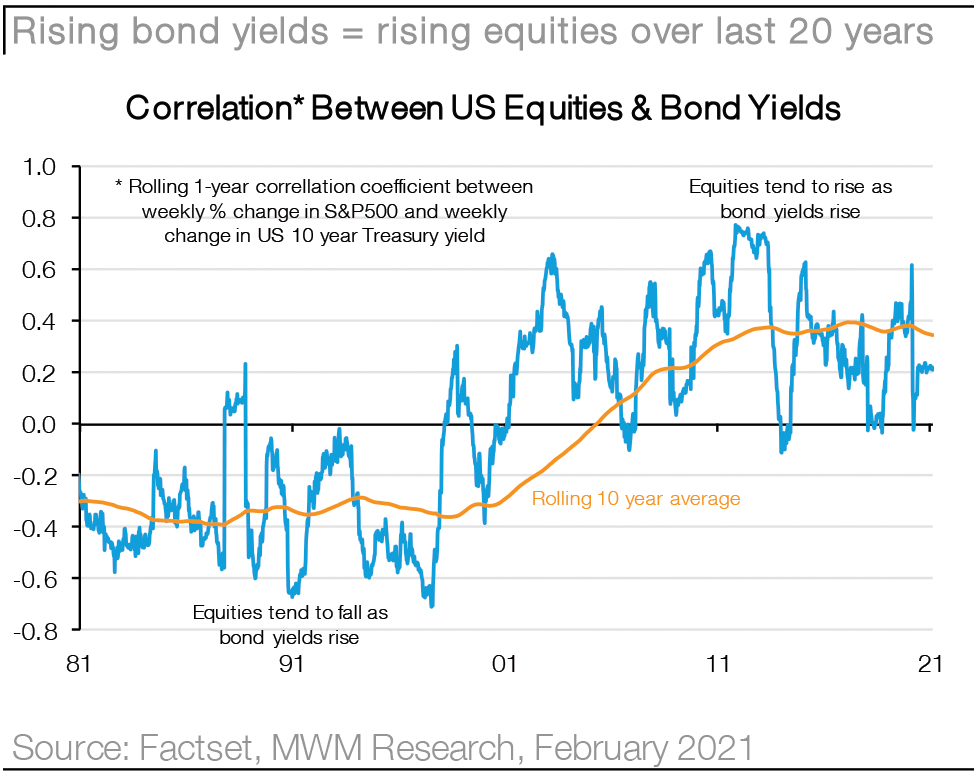

1.Don’t look for a “magic” bond yield level that tips the equity market over: Historically we have been focused on when bond yields begin to undermine the return from equities (i.e. begin to slow the accent) rather than when they drive the market lower. Our rule of thumb was that this began to occur when the US 10 yield bond yield hit 3.5%. Why slowing the accent rather than driving a correction? Because rising yields in isolation can’t shift relative return expectations (making the risk-reward from equities less attractive) but generally it has required a combination of other factors such as policy tightening/policy signalling (i.e. taper tantrum in 2013) to drive a more broad based or sustained equity correction. While equity valuations are expensive, we think the rise in yields is a signal for equity rotation rather than an equity correction at this stage.

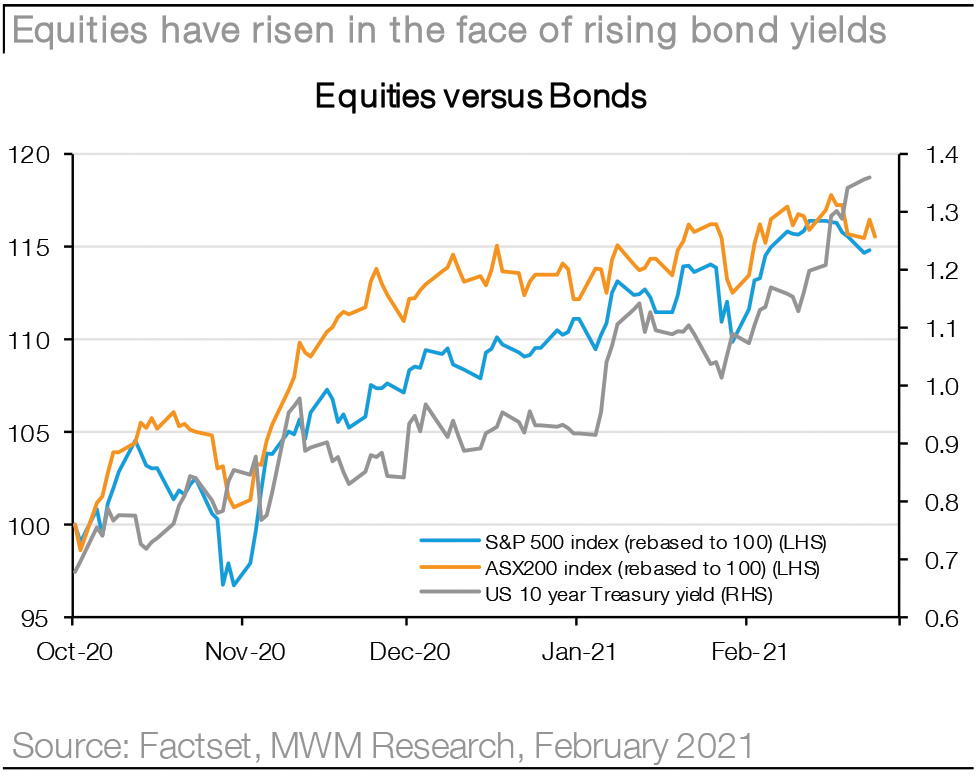

2. The speed of rising rates does matter: The pace at which bond yields are rising has been an important driver of how markets have reacted to higher yields. Traditionally a 1 standard deviation move in the space of 4-6 weeks has been enough to drive a reversal in the positive correlation with yields (i.e. higher yields driving a lower market). The rise in yields seen since November-20 is already a 1 standard deviation event, but we think it represents a normalization from overly pessimistic levels due to COVID-19 rather than a sign they are about to go substantially higher (a view supported recently by the Fed). In addition, the rise in yields has been driven by both rising real rates (confidence around recovery) and not just higher inflation expectations (which at this stage remain a positive not negative signal).

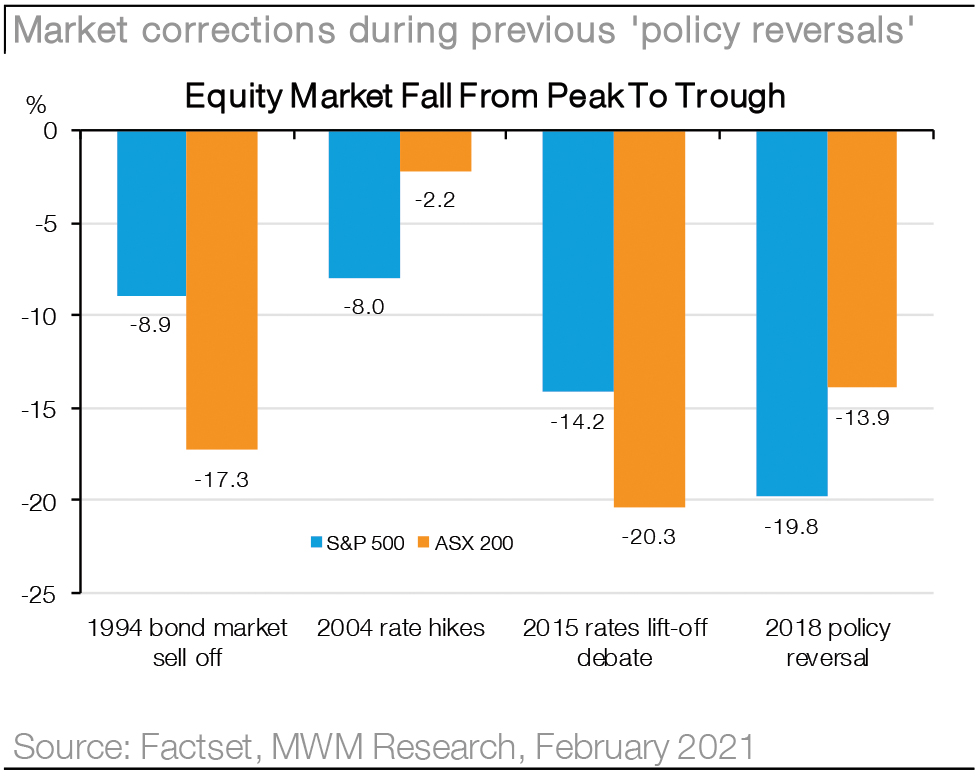

3. Policy makers will let inflation run hot: Historically a reversal in policy direction by the Fed has been a major catalyst for equity market weakness when accompanied by rising rates. We saw this in 1994/2004 (Fed tightening) as well as in 2013/2015 (rates lift-off debate) and 2018 (Powell’s policy reversal). We don’t see an imminent reversal in easing monetary conditions and the Fed has signalled that they will let inflation run “hot” and are prepared to look through any near-term inflationary pressures if it proves to be transitory. Thus, we see limited risk that central banks are about to reverse language and tighten policy within the current backdrop of gradually rising long rates.

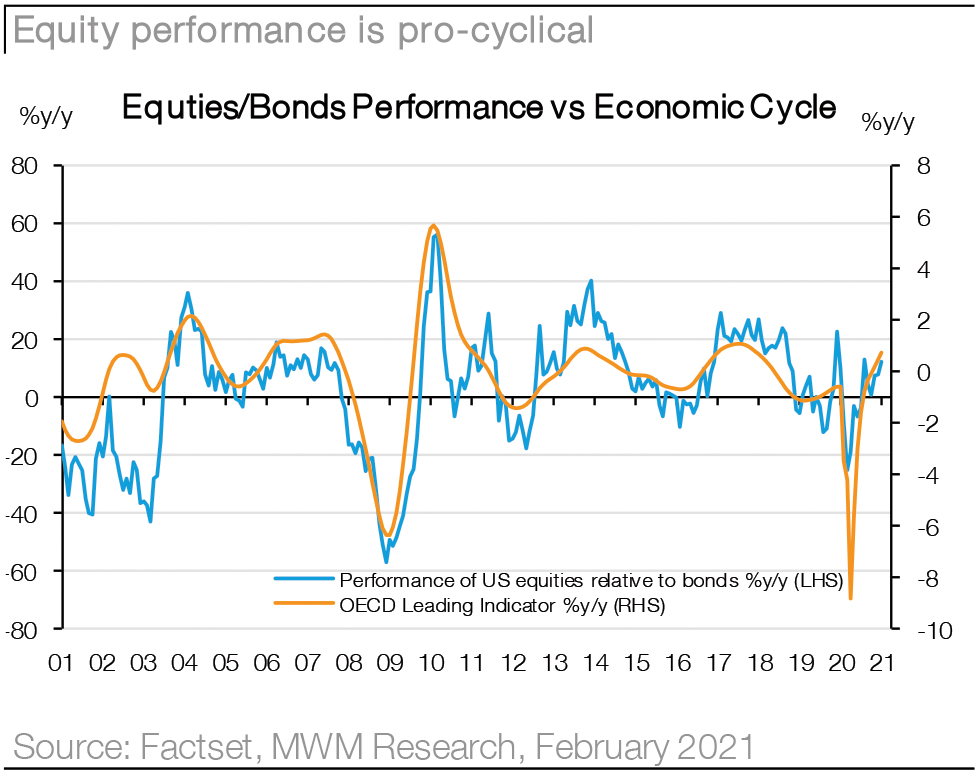

4. Fundamentals are still improving: At this stage, there is a strong reflationary pulse behind the rise in bond yields. Macroeconomic surprises remain positive and corporate fundamentals are improving quickly even if valuations are extreme in some areas. We think the signal from real rates remains positive for equities and it is likely that leading economic indicators remain firm as the services sector begins to recover. It is hard to ignore extreme positioning within some segments of the equity market and if profit taking in high multiple areas is reallocated towards cyclicals (rather than using cash), then equity markets will definitely struggle, but we are not at that point. Our concern begins to rise when expectations have reset at higher levels for both the economy and earnings.

Pulling this together, we think bond yields still have some way to go before they begin to choke off equity bull market and we would have to see a number of other factors begin to also turn less favourable – namely economic growth and central bank policy direction. If higher yields begin to choke off an economic recovery and central banks are forced to reverse course and begin tightening monetary policy, then this would be a lethal combination for equities and one which would quickly require a more defensive asset allocation. However, there are few signs that rates have reached a level that is undermining the recovery (even given elevated debt levels) or that inflation risks are about to drive policy makers to reverse easy money conditions. We think it’s too early to sell out of the equity bull market and while rising bond yields may (in the end) be a contributing factor to more sustained equity market weakness, they are not at the level that threatens the risk rally.

Our next Investment Strategy Update will outline how we are investing for rising bond yields within the equity market

Jason and the Investment Strategy Team

________________________________________________________________________________________________________________________________