Bear markets can have false dawns: Equity markets have bounced strongly in recent days off the back of news that the US government is close to a substantial fiscal stimulus package. Recovery days, whether they be based off new information or just oversold conditions, are normal during bear markets but in the early stages, they are more often than not false dawns. It is encouraging that markets are not ignoring positive developments (this indicates that investors have not given up hope), but we caution against getting overly optimistic or assuming markets are suddenly on a one-way express ticket higher.

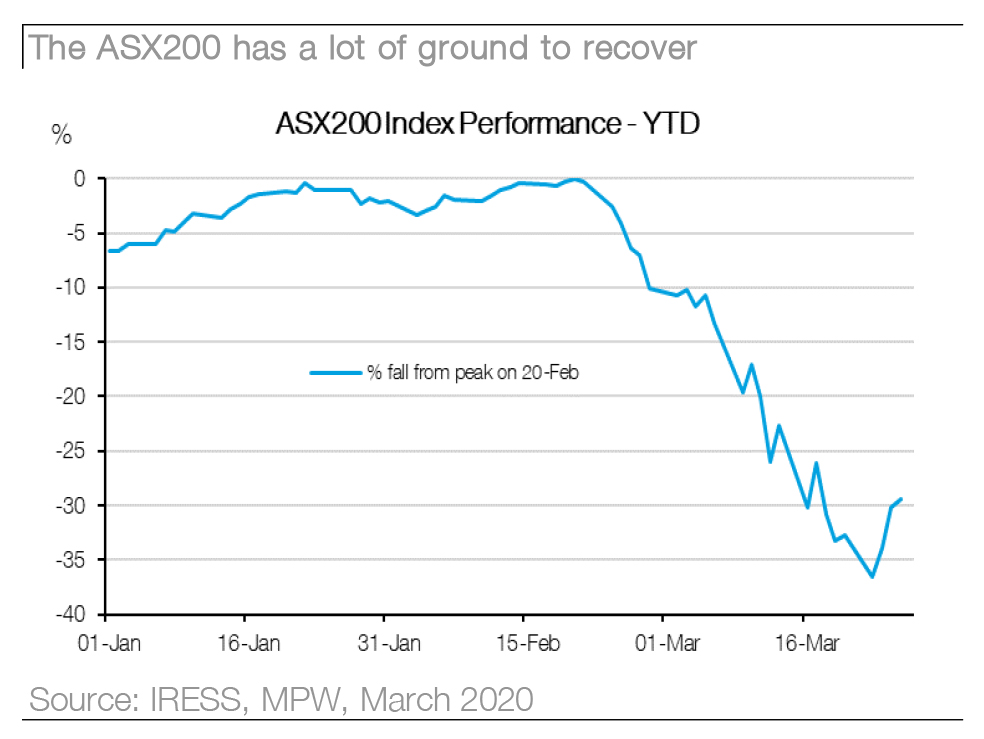

Equities need to go through a “consolidation” phase before they enter a “recovery” phase: We expect the market to have posted strong gains by the time we begin to see economic growth stabilize. However, the market must also go through its own phases and it does not tend to jump from one to the other for good reason.

The cycle can generally be broken down into three distinct phases. Phase one is the destruction stage when all assets fall at once and nothing is immune (correlations tend to one). Phase two is the consolidation phase where the severity of the downturn is better understood and there are policy actions in place to limit the damage. During this phase we look for confirmation across asset classes (fixed income, equities, commodities, currencies) to send similar signals about recovery. And finally, Phase three is the recovery stage where expectations have been reset lower, but markets begin to pre-empt an improving outlook. During this phase, the risk of disappointment is not enough to offset the hope of improvement given the valuation cushion in place.

Consolidation is where markets get a handle on “second” round impacts of a crisis: Historically, the catalyst for moving from the destruction to the consolidation phase is adequate policy support or that sellers have been exhausted and markets have become outright cheap. The key reason why there needs to be a consolidation phase is because this is when markets get a better handle on second and potentially third round implications of a shock, without once again driving a cascade of new selling. In this instance, the second round implications of the shock are assessing how credit markets continue to function (and there are clear areas of stress still in markets in addition to the likely uptick we are likely to see in credit downgrades and defaults) and how the shock to confidence might impact variables that are key to the path coming out of the downturn such as investment, employment and spending.

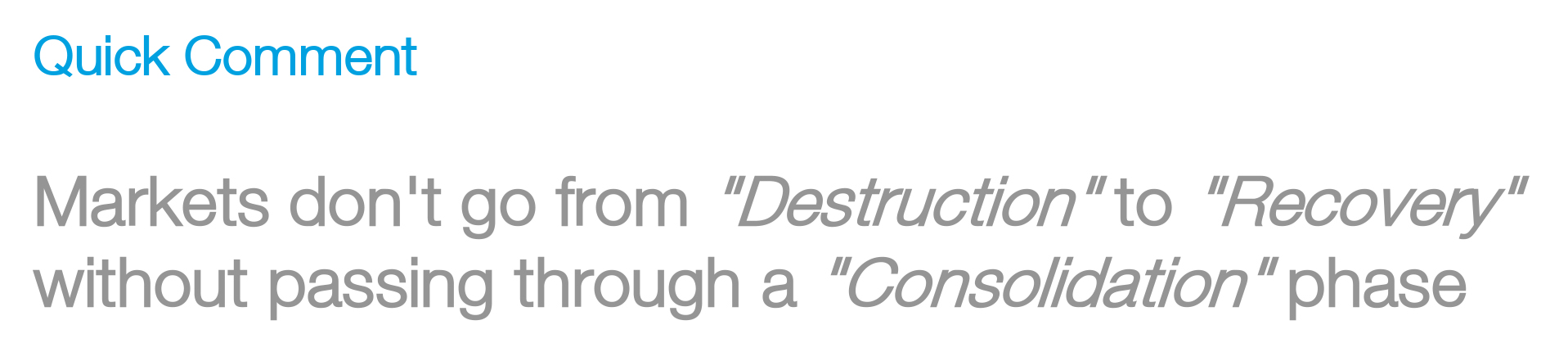

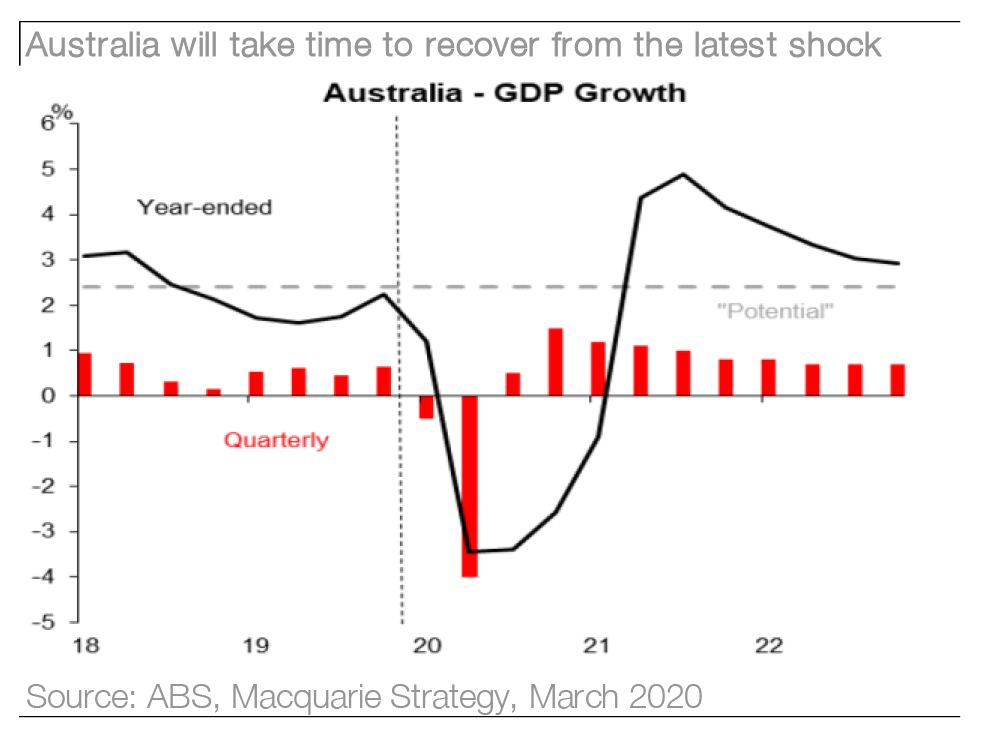

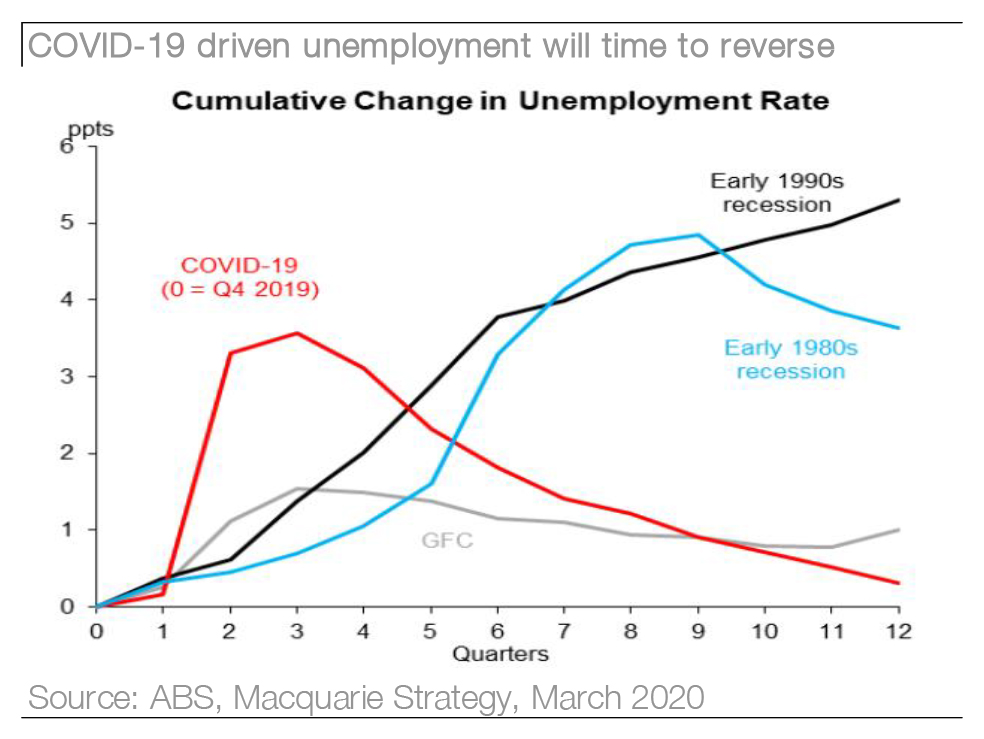

Consensus is over optimistic on how quickly economies revert back to pre-crisis levels: The crisis is about to hit hard. Policy makers are acting fast, but they do not appear likely to get in front of the damage now. We think consumers will have scars from job losses and falling incomes. Similarly, it will take time for employment to pick up, business investment to restart and for households to get over the wealth destruction that has occurred.

Growth will bounce back (more U-shaped than Vshaped), but we think a recovery that gets us back near pre-crisis levels is a best case outcome and that it is overly optimistic to think this is a central case. In addition, corporates are now tapping funding markets more aggressively than expected and not just for refi requirements (in recent days oOh Media, Qantas, Cochlear).

This trend could continue as the shock of earnings cuts is crystalized but also provide a mild headwind for upside. Finally, as we set out early on in our markers for a sustainable bottom, we continue to believe that a stabilization in infection rates (in both the US and Europe), is an absolute pre-cursor before we enter Phase 3 for the equity market. Until this time, there remains a great deal of uncertainty around how long containment efforts will be in place and the potential for disappointment and continued voalitlity remain high.

Approach the rally with caution: With markets down more than 30%, long term investors might want to begin averaging down into selected heavily sold off names (see Quick Comment: “Stock Selection in the Embrace of a Bear Market” 18th March). However, we caution against getting overly bullish on the first signs of an equity market rally when there remains substantial uncertainty around what governments are looking for in order to remove containment efforts and what the economy will look like on the other side.

We are confident of getting past the crisis, but it will take time and will require patience. The market will need to enter a consolidation phase where financial markets are sending consistent messages (i.e. lower credit spreads, upward sloping yield curves, higher bond yields, weaker defensive currencies and cyclical strength in equity markets) as well as more positive news on the virus itself.

At home, the breadth of corporates removing guidance is worrying in that we suspect it results in significant earnings / dividend cuts and lessens transparency around the need to also tap funding markets. We have already set out our markers for a sustainable bottom (see Quick Comment: “Our Markers for a Sustainable Bottom” 14th March), for the very reason that we did not want price action to drive us into changing our view. Positive developments are underway, but we would be looking to raise cash into strength in order to wait until signs of the “Recovery” phase are clearer.

Jason and the Investment Strategy Team

_______________________________________________________________________________________________________________