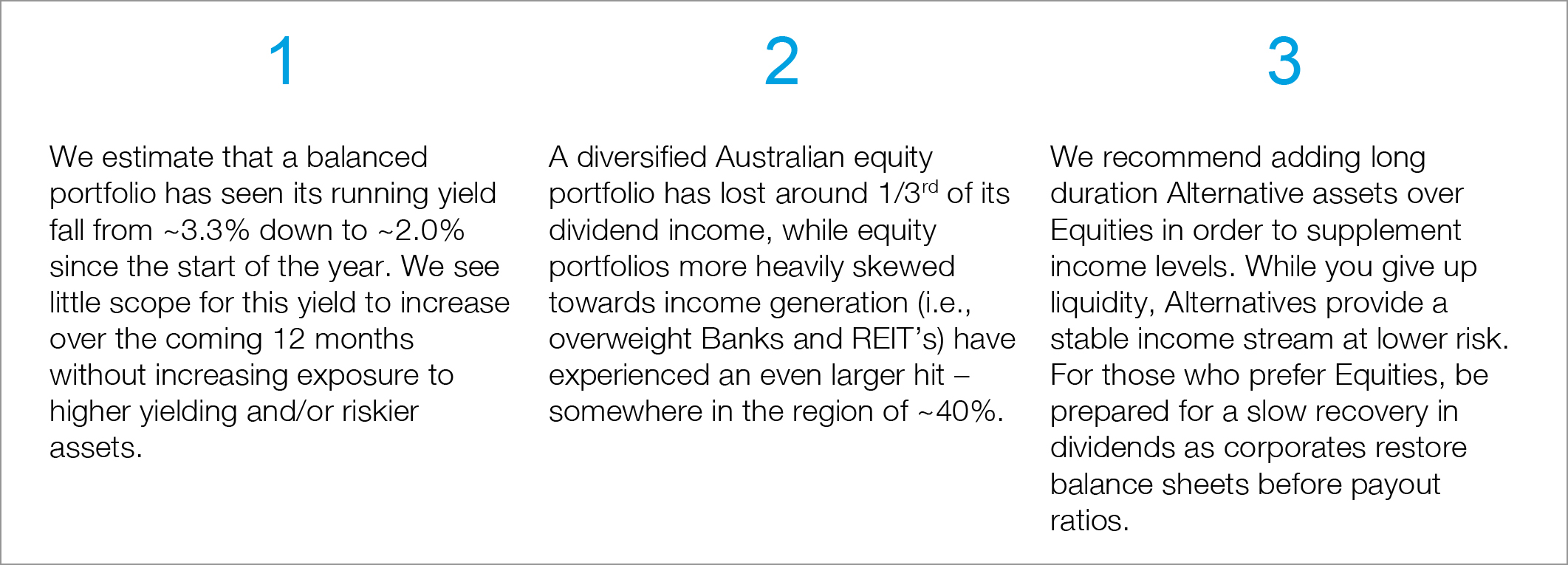

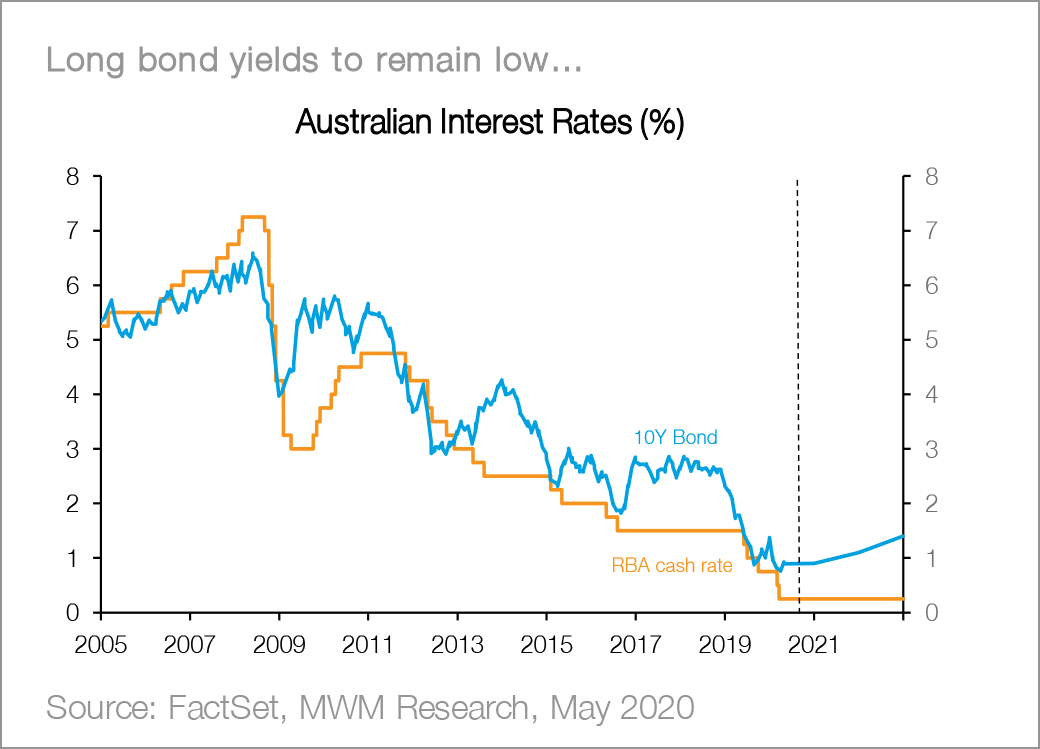

The coronavirus is driving a perfect storm for income investors. Those focused on income are suffering from a dramatic decline in bond yields and dividend income and for those investments where yields have spiked (i.e. credit, emerging market debt), it has come with a substantial increase in volatility.

We see little way to avoid a hit to income in the current environment. In a world of structurally low interest rates, generating and growing income has become and will remain exceptionally challenging. Investors are being forced to move out the risk curve in order to boost returns either from income, capital appreciation or a combination of both. For those investors who are not prepared to take on more risk, the consequence is an inevitable decline in returns.

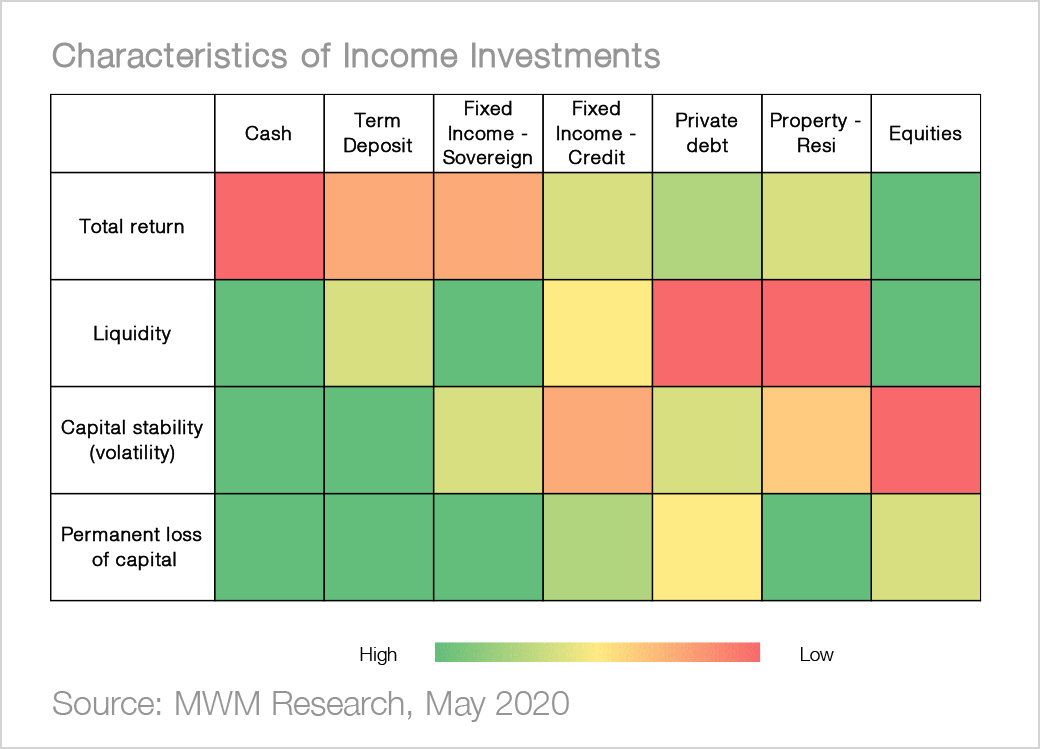

Investing for income in a low interest rate environment still requires investors balance the same risk-return trade-offs as in a high interest rate environment. However, investors will now be faced with the prospect of moving into non-traditional income yielding investments, out the risk curve or adding concentration risk if they are to meet historic return objectives.

This may mean term deposits replace cash (at the expense of liquidity), credit is needed for income pickup versus traditional bond allocations (at the expense of quality) while higher allocations to equities are used for both income generation and yield support (at the expense of stability) as well as reducing broad exposure at the expense of higher allocations to higher/stable dividend yielding areas.

Investment in real assets provides a yield pick-up that exceeds most other options, but investors give up liquidity for this privilege. Direct commercial real estate opportunities offer yields of around ~6% and above depending on the quality of asset but risk levels have also risen due to a changing demand outlook as a result of the “work from home” push. Existing (brownfield) direct infrastructure assets can offer yields of around 8% and above – but again the quality of the asset is critical and the capital lock up periods are long – the reverse of what investors are prepared to do when market volatility and fear is high.

We discuss how an investor can maintain and/or grow the income portion of their portfolio in an environment where the yield on traditional cash, fixed income and now equity investments has fallen. We start this discussion/analysis with a brief outline of why the outlook yield assets has deteriorated so significantly.

#1: What has happened to the yields across different asset classes?

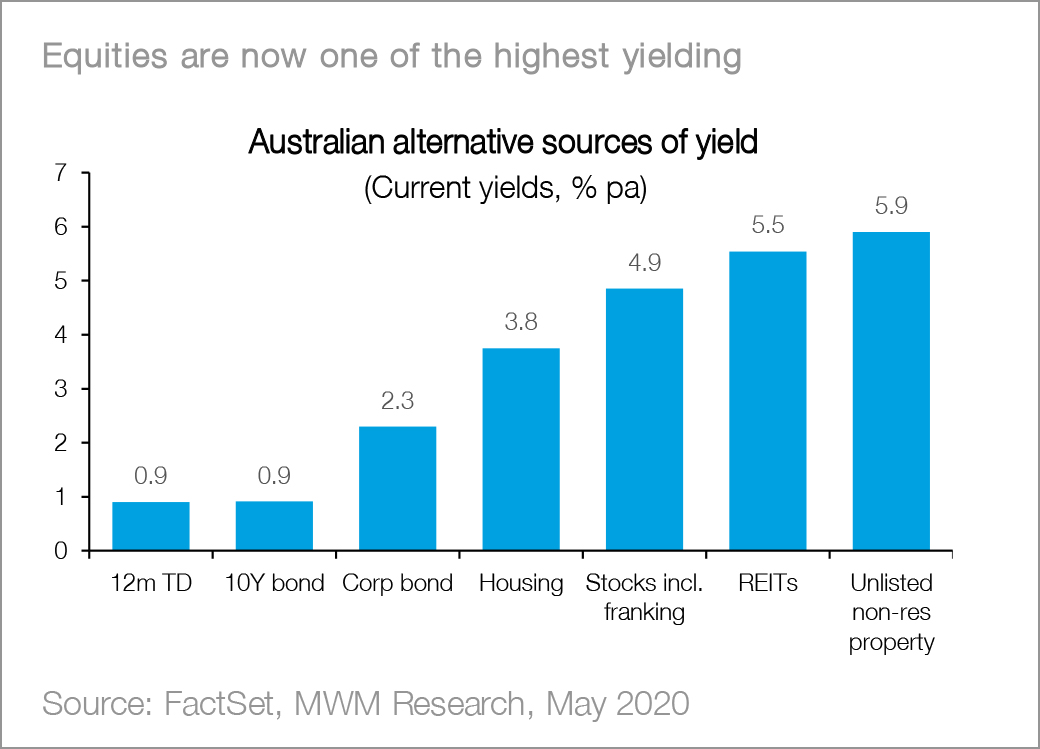

Versus pre COVID-19 levels, income levels on most assets except for short dated term deposits have fallen. Perversely this has not been the case with TD’s despite further cuts to the official cash rate because deposit taking institutions now have a greater demand for attracting liquidity.

Income levels from equities have fallen significantly as companies have been hit with a hard stop to revenues. In addition, there has been an aggressive timetable for equity capital raisings which is further diluting income from these assets. REIT’s have also seen a dramatic change in their income producing ability as containment efforts have added to structural concerns across the sector. In addition, yields on housing have also been falling as unemployment picks up and fears of more widespread consumer defaults impact the rental outlook.

On top of the decline in equity income, the fixed income component of portfolios has also taken a meaningful hit as government bond yields have collapsed in response to aggressive monetary policy easing. Credit spreads have also moved aggressively wider as default risk has risen.

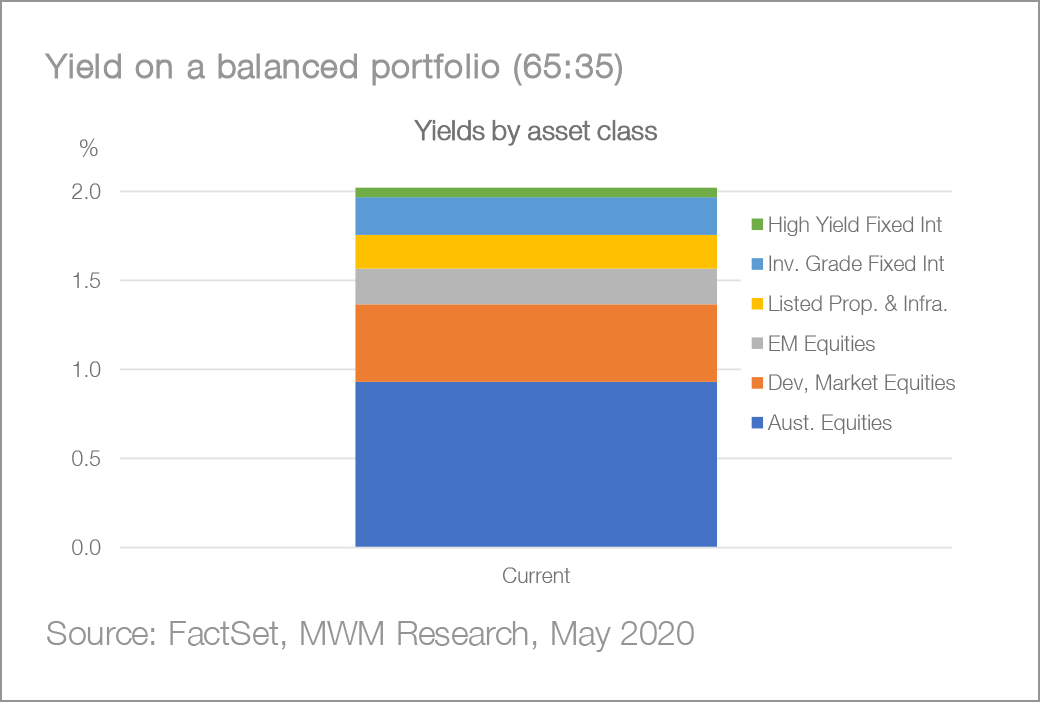

#2: What should be expected for the yield on a balanced portfolio?

Based off current market expectations, the yield on a ‘typical’ balanced portfolio (65% growth/35% defensive split) sits currently around 2.0%. We think the major hit to income generating assets has now been taken. However, its unlikely that there will be a meaningful increase in yields across equities, listed property and fixed income (IG) in the next 12 months.

#3: What are the best income/yield options?

We believe equities retain a strong attraction for income seeking investors given the yield spread over cash and bonds at 4.7% and 4.0% respectively. Admittedly, growth assets (equities) are likely to undershoot their near-term income goals and versus prior years the yield spread has fallen dramatically.

We do not recommend chasing higher yielding assets to offset a near term income decline. At present, the trade-off for higher yield is higher concentration risk and we do not believe investors should be forgoing the benefits of diversification within an equity portfolio in order to increase yield.

At present, equities are our preferred asset class for income seeking investors on the proviso they can get broad portfolio exposure. While equities might not offer the highest absolute yield (private debt or long duration alternative assets offer more), we are comfortable that broad sector exposure can minimize the risk of further dividend disappointment at an individual stock level as well as offsetting a staggered reintroduction of dividends into the future. Australian banks have been a significant area of focus for income investors in the past. We think 2020 will be the low for dividends paid, but the recovery will be gradual over the coming 12-24 months.

Listed Property & Infrastructure come next and are also attractively priced with a 4.0% forecast yield after assuming dividend cuts. REITs have featured prominently in ‘yield’ portfolios but unfortunately, corona virus containment efforts have compounded structural pressures that were already evident across large parts of the listed REIT’s space by cutting foot traffic to near zero. Unfortunately, we don’t see a fast exit from these conditions for REITs and think the reset back to more normalized dividend levels will not be instantaneous.

Fixed income (sovereign bonds) are our least preferred income option where yields are generally less than 1%. We think balanced portfolios can gain some yield pick-up within fixed income through investment grade credit, as we feel default risk remains too high to add risk to high yield markets given current spread levels. We are neutral sovereign risk, overweight Investment Grade, neutral high yield and underweight EM’s.

#4: How do we best supplement income levels?

- Switch out cash for term deposits which have a marginally higher return although at the expense of liquidity. Alternatively, consider a high-quality cash enhanced product.

- In equities, there are both direct and indirect ways to supplement income: 1) In direct equities, it is possible to raise exposure to stable dividend growers (lower yield but less volatility); and 2) For indirect exposure there are specific income (over index) funds which will have higher yields; and 3) For a combination of “yield plus capital appreciation”, we recommend raising offshore equity exposure.

- Within fixed income there are a number of options: 1) Selected offshore sovereign bonds offer a higher return then Australian sovereign bonds; 2) Diversified credit portfolios offer a higher return than sovereigns but with greater volatility; and 3) Private debt surpasses all other fixed income investments for yield but also at the expense of liquidity.

Jason and the Investment Strategy Team

________________________________________________________________________________________________________________________________