Australia’s 7% contraction in GDP during the June quarter was the largest since quarterly records began in 1959. Following on the back of a 0.3% dip in the March quarter, it brought a shattering end to almost three decades of growth without a recession, despite two significant global financial crises and the Asian/Emerging Market crisis in the interim.

Whether these outcomes are actually due to luck or sound management can be debated, but regardless, we might be going through another “Lucky Country” moment. Despite the recent resurgence and lockdowns in Victoria (which at the time of writing look to be coming under control), I think there’s broad recognition that we’ve escaped the worst of the pandemic compared to other countries with relatively less cases and deaths per capita than most, and there’s good evidence to say that our economy isn’t faring too badly either in contrast to the rest of the world.

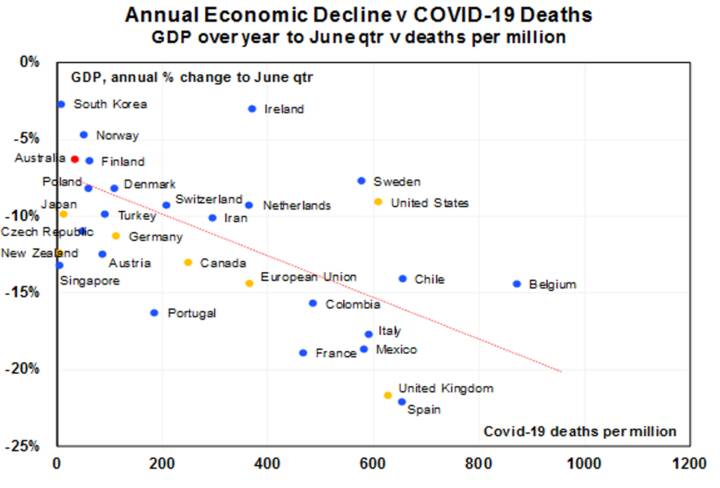

Of the OECD countries, Australia ranked 9th in GDP performance over the June quarter, well ahead of our peers such as the Netherlands (-8.5%). South Korea (-9.6%), Canada (-11.5%), and Spain (-18.5%)1.

The list of economies which outperformed Australia’s were dominated by Scandinavian and Baltic countries, with the notable exception of Sweden, whose government took a contrarian “hands-off” approach to managing the pandemic. Sweden’s economy (-8.3%) held up relatively well through the period by global standards, but if you compare the results of their two closest neighbours, Norway (-5.1%) and Finland (-4.5%), that sheen starts to pale a little2.

There will be a lot of factors at play here, but it’s notable that despite Norway and Finland having a combined population that’s roughly the equivalent of Sweden’s, they’ve had roughly a quarter of the coronavirus cases.

Elsewhere that link wasn’t so evident: Ireland has recorded slightly higher rates of COVID per thousand head of population than the UK, but their economy only shrank by 6.1% over the period, compared to contraction of more than 20% in the British economy3.

More broadly, the combined economies of the European Union contracted by 11.4% and the US by 9.1%, which is reasonable considering that Europe and North America have borne the brunt of the pandemic4.

Source: ourworldindata.org, Bloomberg, AMP Capital

In contrast to the rest of the world, China recorded strong growth of 11.5% in the June quarter5 following a 10% contraction in the first quarter. Trade tensions notwithstanding, this is good news for demand in the global economy and the largest Chinese trade partners, including Australia, should particularly benefit.

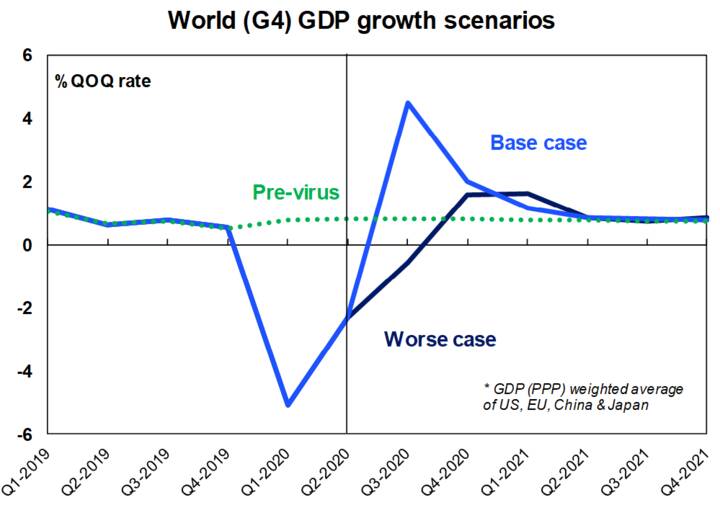

Source: AMP Capital

Our base case expectations are that the global economy will return to growth in the current quarter, or by the end of the year in a worse case scenario. This is, of course, based on the assumption that the pandemic doesn’t worsen significantly in that time., However, we’ve witnessed over recent months the reluctance of governments, including the US government, to put their economies back into complete lockdown even in the face of rising case numbers. We know a lot more about the virus now and how to manage it, and politicians are obviously hopeful that we can deal with these outbreaks without having to resort to measures that inflict such blunt-force trauma on our economies that we saw in March and April.

1,2,3,4,5 OECD: https://data.oecd.org/gdp/quarterly-gdp.htm#indicator-chart