- Heading into the new year we expected to see a strong growth rebound, the (re)emergence of some inflation, a rise in bond yields and for last year’s winners to become this year’s losers, as investors rotated out of expensive/over-owned growth stocks into cheap/under-owned value and cyclicals.

- 2021 is unfolding faster than expected but, not different than expected. It was assumed that the bond market would remain well behaved and that the transition from economic “recovery” to economic “expansion” would be relatively uneventful. The past few weeks suggest may be more disruptive than initially thought.

- For the most part, bond yields are rising for the “right” reasons as the economic growth outlook improves and inflation expectations normalise. It is possible that yields might overshoot on the upside and/or ultra-supportive policy conditions are reversed earlier than expected, but this remains a risk to hedge against and at this stage we don’t think the recovery, or the bull market are at threat.

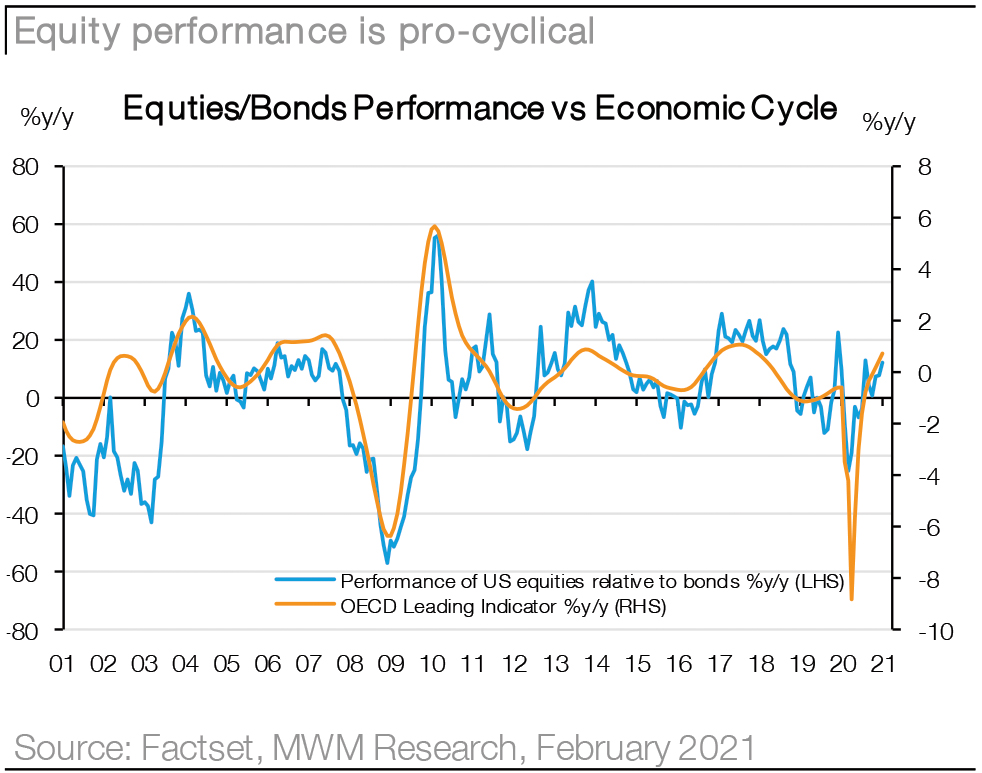

- Equity valuations have been boosted dramatically by falling bond yields and so it makes sense that rising yields present a headwind for high multiple stocks. However, economic growth is also rising, and this is a powerful tailwind for stocks.

- We believe rising bond yields will drive further rotation into cyclicals and financials rather than drive capitulation for equity investors. Historically equities have outperformed bonds during cyclical rebounds even when bond yields are rising. We think equity weakness will be temporary and that policy makers will remain committed to easy policy and ensuring the current tantrum does not infect other assets.

- Stay with the reflation trade and remain underweight sovereign bonds. Rotation towards value/financials and small caps is a positive confirmation of growth not an end to the bull market.

What to do about the rise in bond yields?

In last week’s Investment Strategy Update – “Why it will require more than rising bond yields to kill the equity bull market” we outlined the combination of factors we thought were necessary to kill off the equity bull market. This included higher yields in combination with a reversal in monetary policy and a potential deterioration in macroeconomic fundamentals.

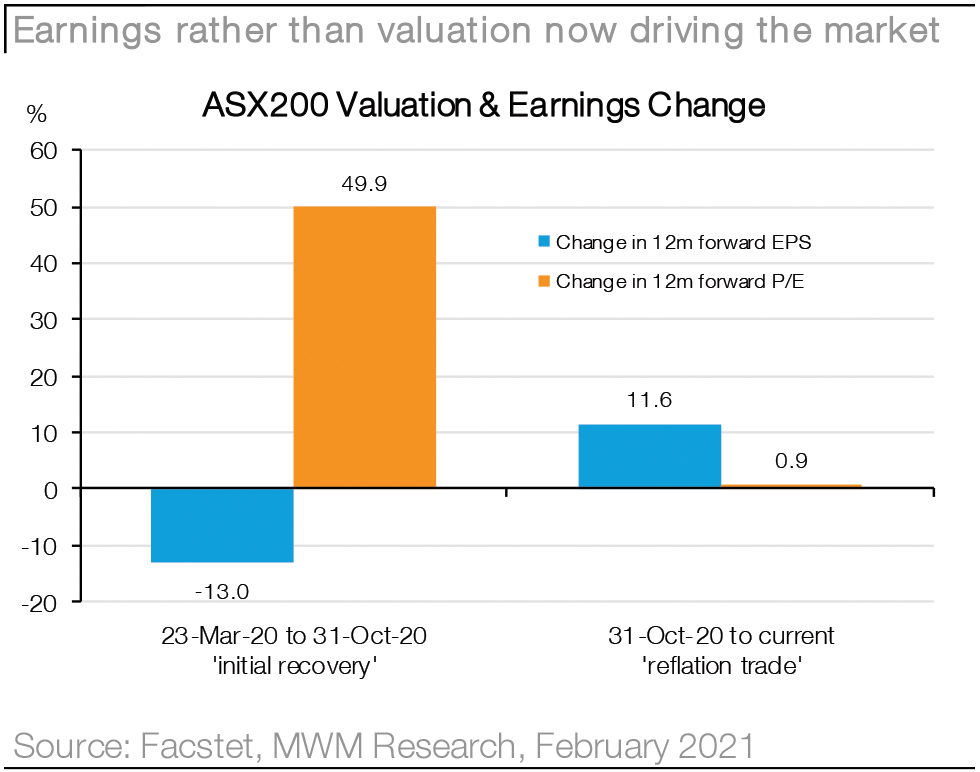

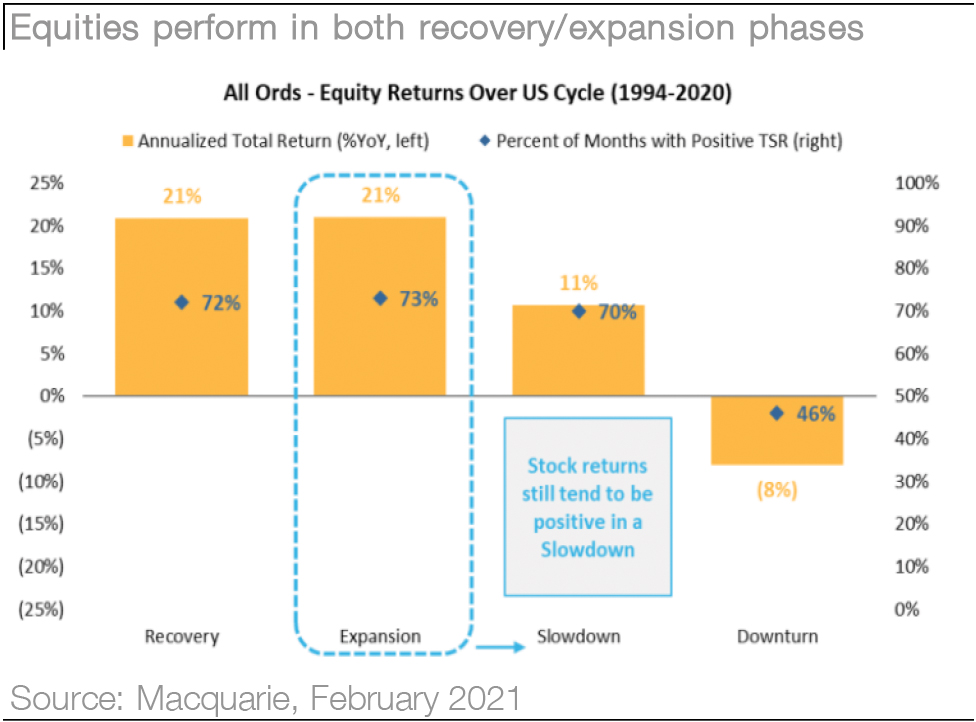

We have not altered this view. We don’t think higher bond yields driven off the back of rising growth and normalizing inflation are more than a temporary disruption for the equity market. Improving economic growth is a powerful tailwind for equities as we transition to the earnings expansion phase of the cycle (from valuation expansion). Like the taper tantrum in 2013 when Federal Chairman Ben Bernanke announced (prematurely) that it would be appropriate for the Federal to reduce its bond purchases, we think markets will reset, the economic expansion will continue (potentially for a number of years) and that higher yields simply reinforce the rotation away from bonds and highly valued growth stocks but not away from equities into more defensive asset classes just yet.

How do you position for rising / higher bond yields?

We doubt the path towards higher rates will be smooth. Even if the risk of bond yields overshooting on the upside has increased, investors should also expect bouts of safe-haven demand which for the most part, could keep yields within a broad trading range as central banks seek to reduce volatility, backstop the recovery via easy financial conditions and avoid contagion (infection) into other asset classes, particularly credit.

It is possible that bond yields rise above Macquarie’s year-end target levels, but we think this outcome is more likely a 2022 event given inflation lags. It is important to remember that markets will keep pushing, but that central bank policy hesitance does not mean policy inaction and so until a happy medium is found, it is likely that we see a further tug-o-war between market forces and central bankers who do not take the pulpit every day.

Thus, while equity market weakness is never desirable, we think the repricing of stocks for a dramatic increase in bond yields is about as credible as the repricing of stocks for permanently low yields was. Low rates were never forever but in the same way, we think it’s premature to expect a reset to sustainably higher rates due to a permanent increase in inflation which also remains highly uncertain at this stage.

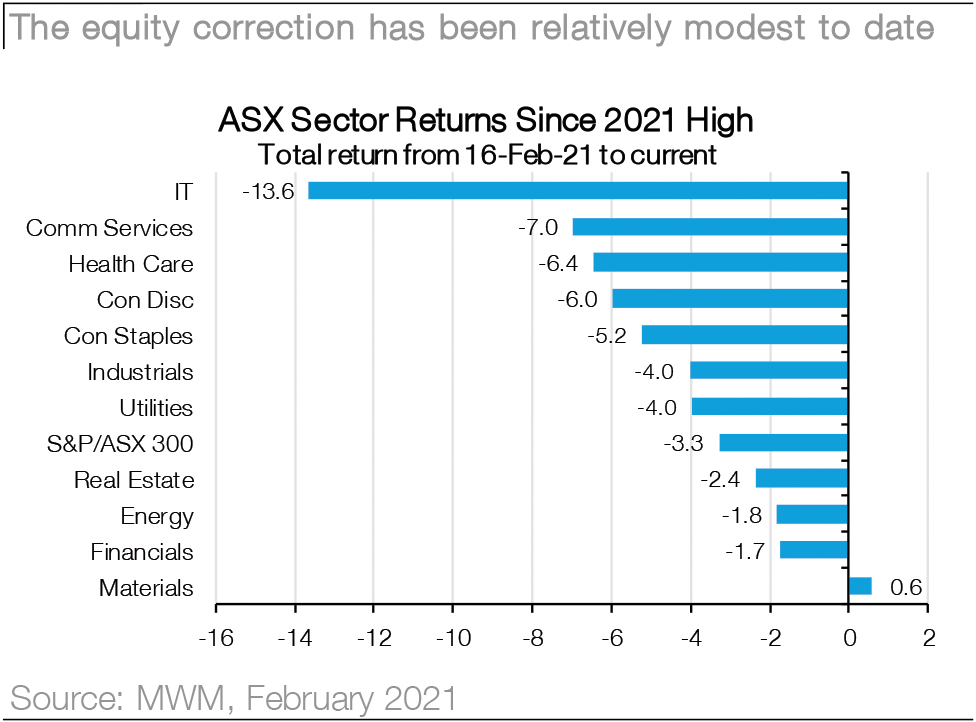

Consequently, we think investors should be prepared for ongoing volatility across financial markets but should be using weakness to continue to rotate into more cyclical areas of the equity market. Our key recommendations for the backdrop are:

- Stay overweight equities which are pro-cyclical and consistently outperform bonds during reflationary periods but:

- Reduce exposure to highly valued / long duration growth stocks particularly those which have been temporarily boosted by COVID-19 lockdowns. Maintain exposure to those which have strong structural growth prospects post a cyclical recovery.

- Increase exposure to cheap / short duration stocks with a preference for domestic cyclicals which are winners from further removal of social restrictions and pent-up demand on services spending (media, capital goods, transport).

- Increase exposure to beneficiaries of a steeper yield curve and a sustained increase in credit growth as conditions normalise (banks, insurance, diversified financials). Interest rate sensitive sectors will remain under pressure despite the prospect of improving earnings (A-REIT’s, Telco’s).

- Increase exposure to inflation hedges such as real assets and/or commodities (energy, materials). While these will also weaken into rising bond yields, they should stabilise as inflation expectations also flatten out. Gold loses its lustre as the opportunity cost of holding a zero yielding asset rises.

- Fixed income investors should be looking to reduce exposure to sovereign bonds while also reducing duration of fixed income holdings. While actively managed sovereign strategies are unlikely to avoid a negative absolute return should bond yields continue to rise, these actions can help reduce the drag and limit the hit to returns if bond yields do surprise on the high side.

- Raise exposure to credit (spread) products which can enhance returns and/or raise income as corporate fundamentals improve due to stronger economic growth and/or balance sheet repair.

Jason and the Investment Strategy Team

________________________________________________________________________________________________________________________________