Client Briefing Updates

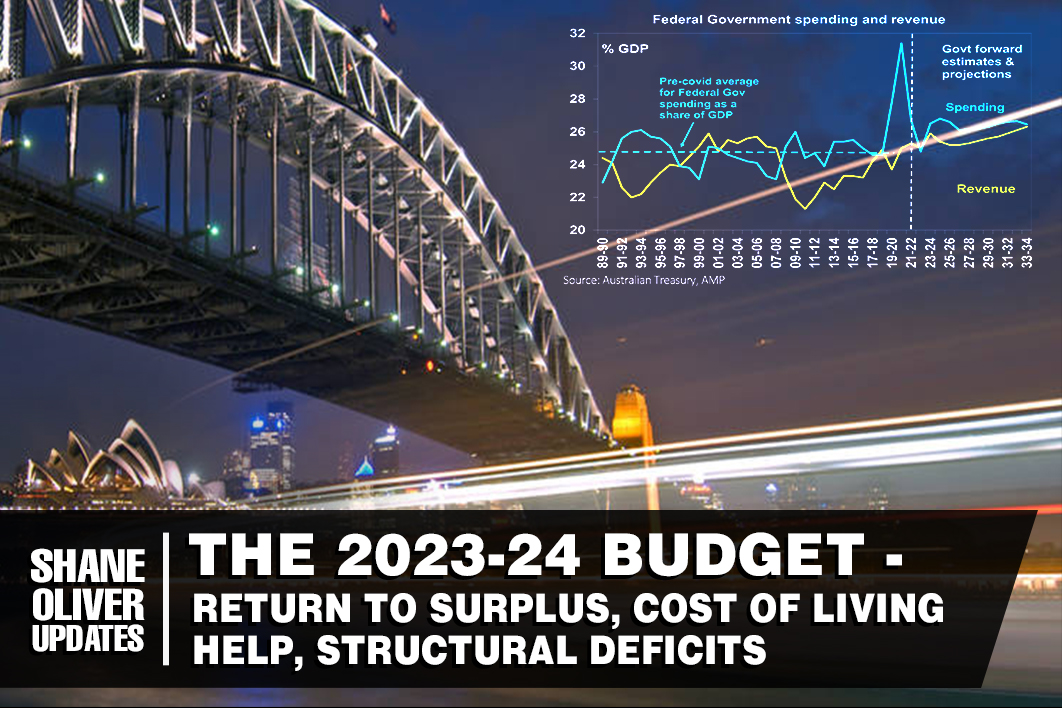

Shane Oliver Updates: The 2023-24 Budget - return to surplus, cost of living help, structural deficits

12 May 2023

This Budget yet again benefits from a huge revenue windfall allowing a surplus this year for the first time in 15 years and cost-of-living relief. At the same time, medium term deficits, while lower, remain leaving the budget vulnerable to anything that upsets the “rivers of gold” flowing to Canberra. Read More..

This Budget yet again benefits from a huge revenue windfall allowing a surplus this year for the first time in 15 years and cost-of-living relief. At the same time, medium term deficits, while lower, remain leaving the budget vulnerable to anything that upsets the “rivers of gold” flowing to Canberra. Read More..

Shane Oliver Updates: Australian home prices

3 May 2023

Here we go again! Prices look to have bottomed as the supply shortfall dominates, but watch rates and unemployment. Yet again the Australian residential property market is surprising with its resilience and defying forecasts for sharp falls. After falling 9.1% from their high in April last year to their low in February, national average home prices rose another 0.5% in April after a 0.6% gain in March and are up by 1.2% from their February low. Read More..

Here we go again! Prices look to have bottomed as the supply shortfall dominates, but watch rates and unemployment. Yet again the Australian residential property market is surprising with its resilience and defying forecasts for sharp falls. After falling 9.1% from their high in April last year to their low in February, national average home prices rose another 0.5% in April after a 0.6% gain in March and are up by 1.2% from their February low. Read More..

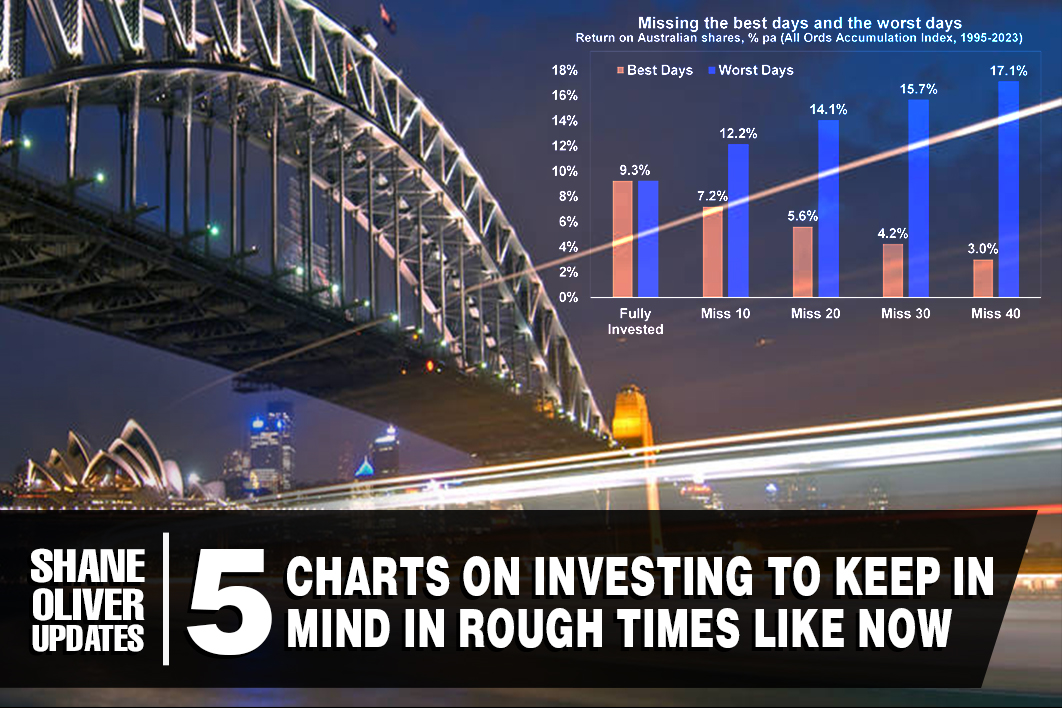

Shane Oliver Updates: Five charts on investing to keep in mind in rough times like now

30 March 2023

Every so often the degree of uncertainty around investment markets surges and that’s been the case for more than a year now reflecting the combination of high inflation, rapid interest rate hikes, the high and rising risk of recession which has been added to in the last few weeks by problems in US and European banks. Read More..

Every so often the degree of uncertainty around investment markets surges and that’s been the case for more than a year now reflecting the combination of high inflation, rapid interest rate hikes, the high and rising risk of recession which has been added to in the last few weeks by problems in US and European banks. Read More..

Shane Oliver Updates: Have Australian home prices bottomed? Probably not.

24 March 2023

From their high in April to their low last month national average home prices have fallen 9.1% making it their biggest fall in CoreLogic records going back to 1980. Capital city average prices were down 9.7% which is their second biggest fall, after the 10.2% fall in 2017-19. However, average price falls... Read More..

From their high in April to their low last month national average home prices have fallen 9.1% making it their biggest fall in CoreLogic records going back to 1980. Capital city average prices were down 9.7% which is their second biggest fall, after the 10.2% fall in 2017-19. However, average price falls... Read More..

Shane Oliver Updates: Shares hit another bout of turbulence

15 March 2023

Shares have hit turbulence again with worries about inflation, interest rates, recession and, now, problems in US banks. After rallying strongly at the start of the year the US share market has reversed much of its year to date gain leaving it down 20% from its January high last year and at risk of a retest of its October lows when it was down 25%. Read More..

Shares have hit turbulence again with worries about inflation, interest rates, recession and, now, problems in US banks. After rallying strongly at the start of the year the US share market has reversed much of its year to date gain leaving it down 20% from its January high last year and at risk of a retest of its October lows when it was down 25%. Read More..

Shane Oliver Updates: Eight reasons we think the RBA should now pause

10 March 2023

The RBA increased the cash rate by another 0.25%, but its commentary was far less hawkish - even opening the door to a pause. Here are eight reasons we think the RBA should now pause. The 3.5% (or 350 basis point) increase in the cash rate over the eleven months since rate hikes started in May last year now clearly surpasses all of the rate hiking cycles seen since 1990 and is the fastest tightening since the rise in the overnight cash... Read More..

The RBA increased the cash rate by another 0.25%, but its commentary was far less hawkish - even opening the door to a pause. Here are eight reasons we think the RBA should now pause. The 3.5% (or 350 basis point) increase in the cash rate over the eleven months since rate hikes started in May last year now clearly surpasses all of the rate hiking cycles seen since 1990 and is the fastest tightening since the rise in the overnight cash... Read More..

Shane Oliver Updates: Seven key charts for investors to keep an eye on

22 February 2023

Shares had a strong start to the year seeing gains into early February around or above what we expect for the year as a whole. But we still expect that it will be a volatile year given that: the process of getting inflation back down won’t be smooth; the topping process in central bank rates will take time with setbacks along the way as we have seen for both the Fed and the ... Read More..

Shares had a strong start to the year seeing gains into early February around or above what we expect for the year as a whole. But we still expect that it will be a volatile year given that: the process of getting inflation back down won’t be smooth; the topping process in central bank rates will take time with setbacks along the way as we have seen for both the Fed and the ... Read More..

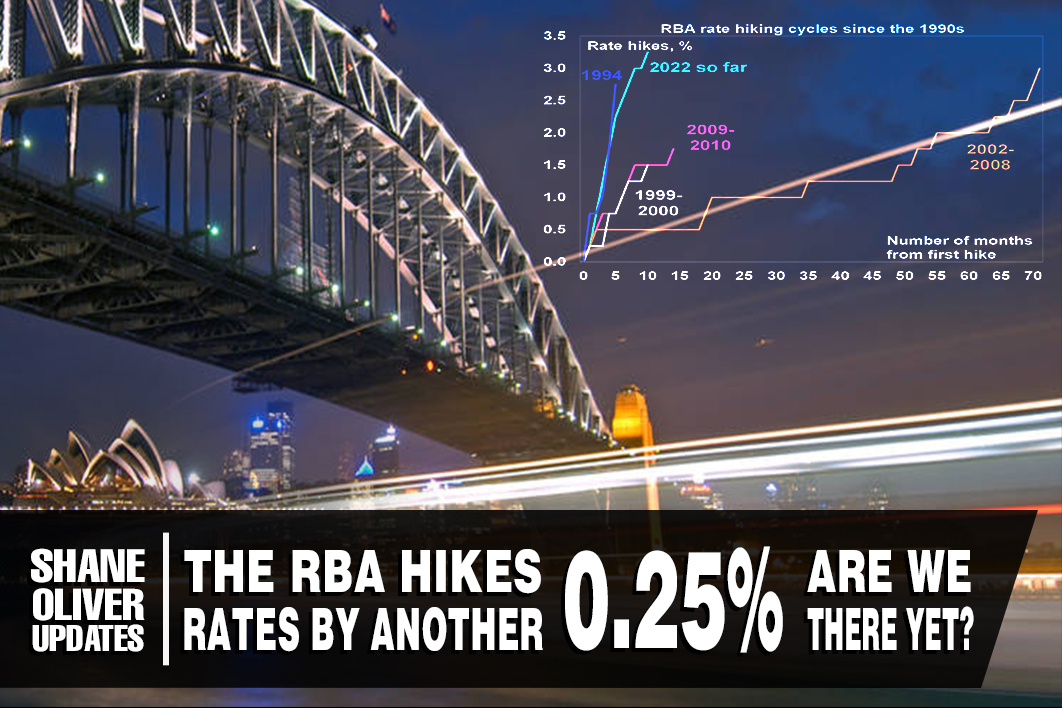

Shane Oliver Updates: The RBA hikes rates by another 0.25% - are we there yet?

15 February 2023

The RBA raised its cash rate by another 0.25% taking it to 3.35%. This is the ninth consecutive rate hike in a row over ten months totalling 325 basis points and exceeds the 2002-2008 tightening cycle (of 300 basis points over 71 months) making it the biggest tightening cycle since the 1980s. Prior to 1990 the RBA cash rate was not ... Read More..

The RBA raised its cash rate by another 0.25% taking it to 3.35%. This is the ninth consecutive rate hike in a row over ten months totalling 325 basis points and exceeds the 2002-2008 tightening cycle (of 300 basis points over 71 months) making it the biggest tightening cycle since the 1980s. Prior to 1990 the RBA cash rate was not ... Read More..

Shane Oliver Updates: 2022 review & 2023 outlook

16 January 2023

2022 was dominated by high inflation, rising interest rates, war in Ukraine & recession fears. This hit bonds & shares hard, driving losses for balanced growth super funds.2023 is likely to remain volatile and a retest of 2022 lows for shares is a high risk. But easing inflation, central banks getting off the brakes... Read More..

2022 was dominated by high inflation, rising interest rates, war in Ukraine & recession fears. This hit bonds & shares hard, driving losses for balanced growth super funds.2023 is likely to remain volatile and a retest of 2022 lows for shares is a high risk. But easing inflation, central banks getting off the brakes... Read More..

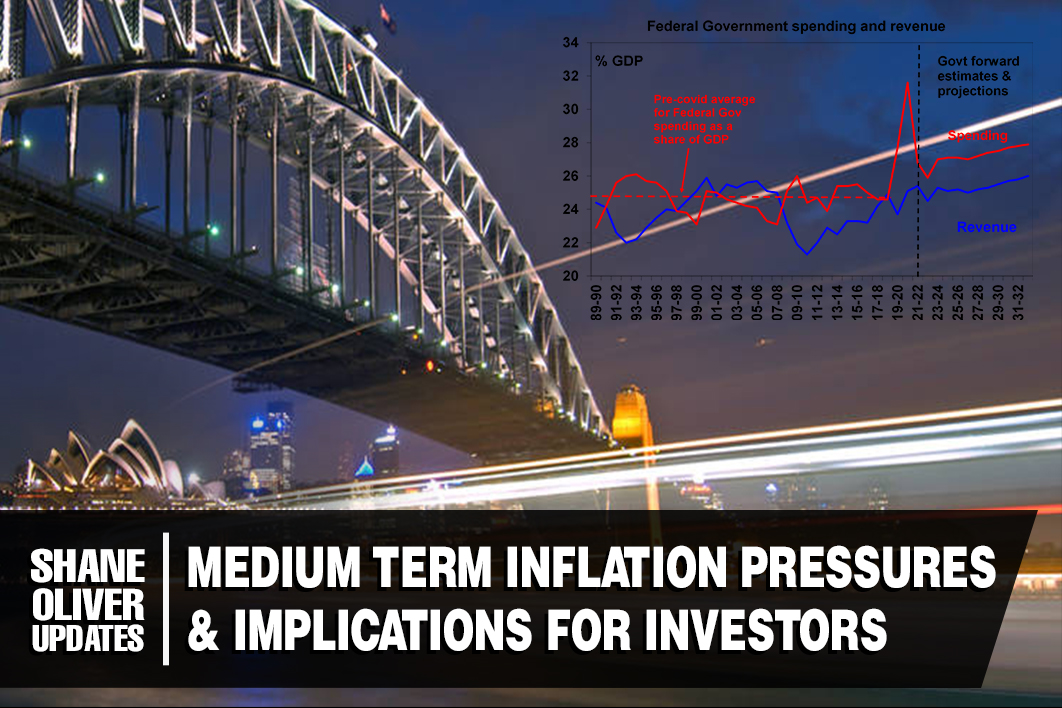

Shane Oliver Updates: Medium Term Inflation Pressures & Implications For Investors

9 December 2022

It’s often said you don’t realise how good something is until it’s gone. This may apply to the low inflation environment that prevailed up to the pandemic. Apart from a few nasty interruptions this saw a downtrend in interest rates, mostly low unemployment, and an upwards trend in asset values (albeit it wasn’t so good for housing affordability). Read More..

It’s often said you don’t realise how good something is until it’s gone. This may apply to the low inflation environment that prevailed up to the pandemic. Apart from a few nasty interruptions this saw a downtrend in interest rates, mostly low unemployment, and an upwards trend in asset values (albeit it wasn’t so good for housing affordability). Read More..

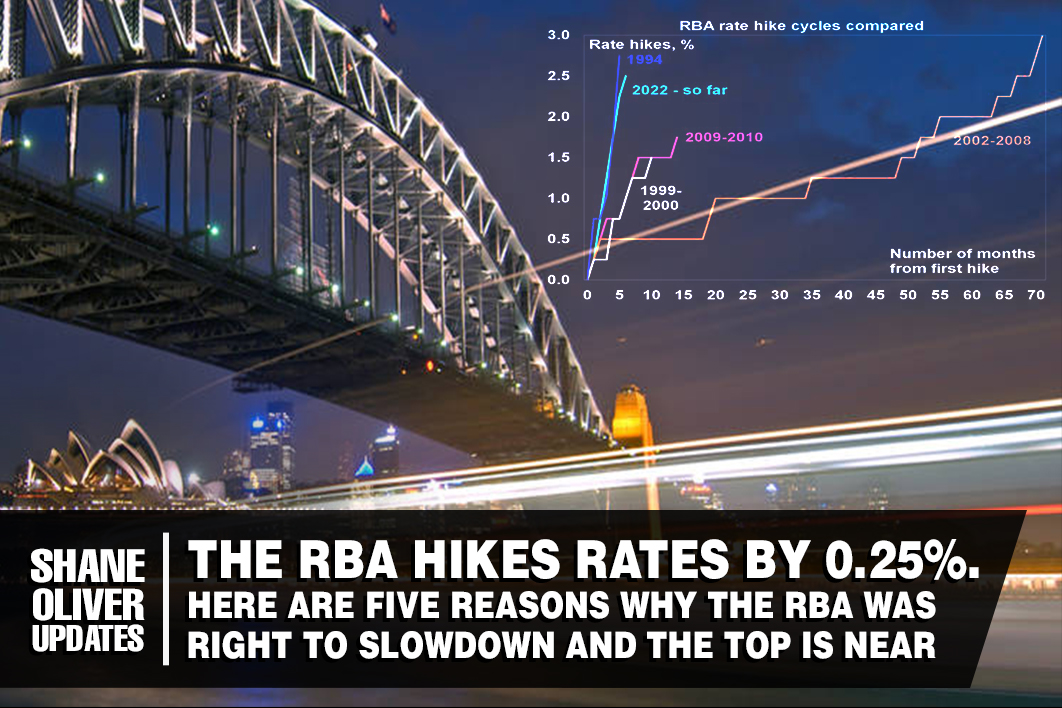

The RBA hikes rates by 0.25%. Here are five reasons why the RBA was right to slowdown and the top is near

5 October 2022

The RBA has increased its cash rate again but slowed the pace to +0.25% which took the cash rate to 2.6%. This was in line with our view and a slowing “at some point” had been flagged by the RBA. In justifying another hike, the RBA noted inflation is still too high and expected to rise further due to global factors and strong demand and that it’s important that medium term inflation expectations remain “well anchored”.Read More..

The RBA has increased its cash rate again but slowed the pace to +0.25% which took the cash rate to 2.6%. This was in line with our view and a slowing “at some point” had been flagged by the RBA. In justifying another hike, the RBA noted inflation is still too high and expected to rise further due to global factors and strong demand and that it’s important that medium term inflation expectations remain “well anchored”.Read More..

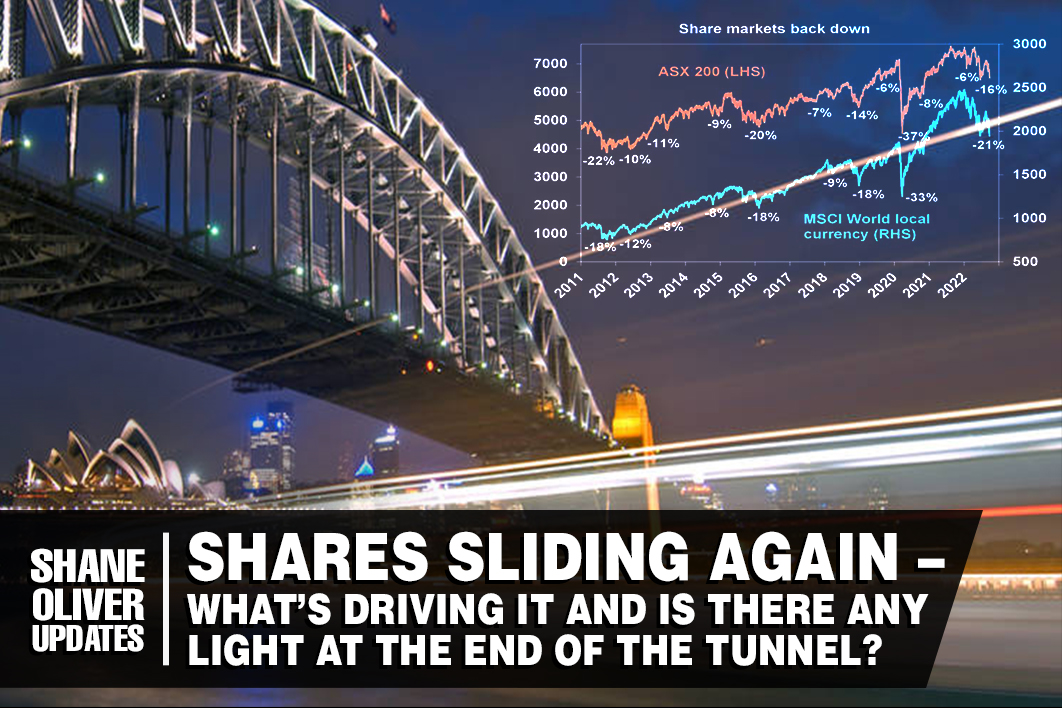

Shane Oliver Updates: Shares Sliding Again – What’s Driving It And Is There Any Light At The End Of The Tunnel?

29 September 2022

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%)... Read More..

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%)... Read More..

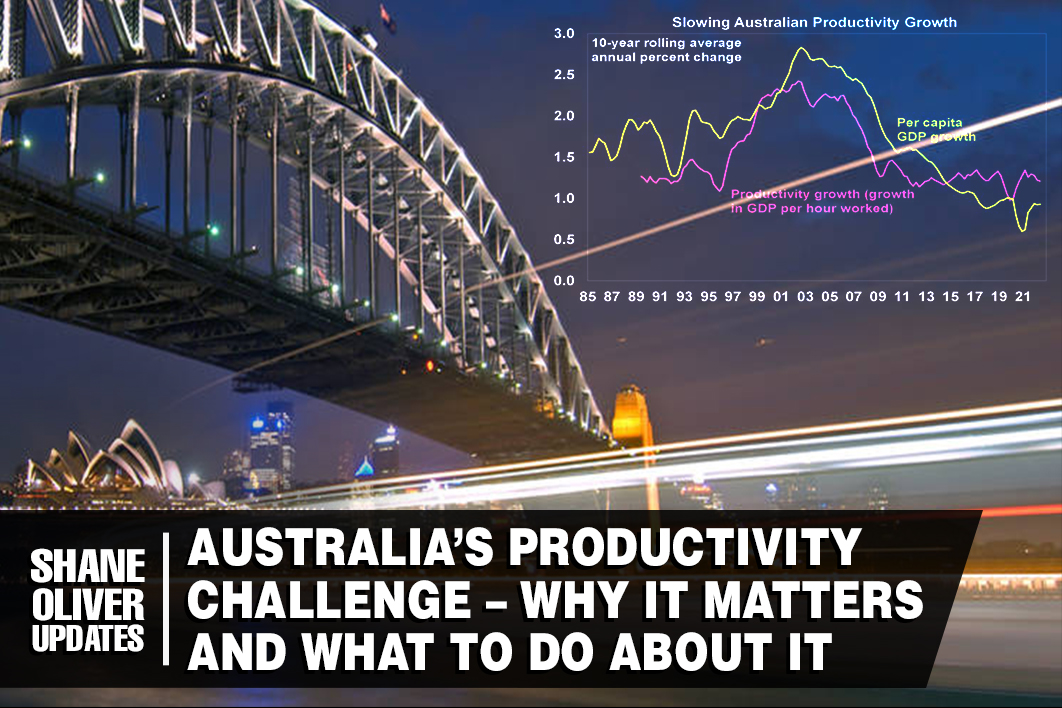

Shane Oliver Updates: Australia’s productivity challenge – why it matters and what to do about it

15 September 2022

A hot topic in recent years in Australia amongst economists and policy makers has been the slowdown in productivity growth. This matters because as Paul Krugman points out “a country's ability to improve its standard of living over time depends almost entirely on its ability to raise its output per worker.” Productivity is the key to driving real wages growth, real profit growth and asset price growth over long periods of time. Read More..

A hot topic in recent years in Australia amongst economists and policy makers has been the slowdown in productivity growth. This matters because as Paul Krugman points out “a country's ability to improve its standard of living over time depends almost entirely on its ability to raise its output per worker.” Productivity is the key to driving real wages growth, real profit growth and asset price growth over long periods of time. Read More..

Shane Oliver Updates: Seven key charts for investors to keep an eye on in assessing the investment outlook

8 September 2022

Shares remain vulnerable in the short term. They had a nice rebound from their June lows into their mid-August highs recovering just over half of their earlier decline (which was -24% for US shares and -16% for Australian shares) helped by mostly good earnings reports and hopes some central banks, including the Fed... Read More..

Shares remain vulnerable in the short term. They had a nice rebound from their June lows into their mid-August highs recovering just over half of their earlier decline (which was -24% for US shares and -16% for Australian shares) helped by mostly good earnings reports and hopes some central banks, including the Fed... Read More..

Shane Oliver Updates: Home price falls accelerated in August – three reasons why this property downturn will likely be different

1 September 2022

“This time is different” have been described as the four most dangerous words in investing by Sir John Templeton. But there is good reason to believe this Australian home price downturn cycle will be different. Most assets (cash is an obvious exception) benefited from the downtrend in inflation and hence interest rates since the 1980s and are vulnerable to its reversal. Read More..

“This time is different” have been described as the four most dangerous words in investing by Sir John Templeton. But there is good reason to believe this Australian home price downturn cycle will be different. Most assets (cash is an obvious exception) benefited from the downtrend in inflation and hence interest rates since the 1980s and are vulnerable to its reversal. Read More..

Shane Oliver Updates: Booms, busts and investor psychology – why investors need to be aware of the psychology of investing

16 August 2022

Up until the 1980s the dominant theory was that financial markets were efficient – in other words all relevant information was reflected in asset prices in a rational manner. While some think it was the Global Financial Crisis that caused faith in the so-called Efficient Markets Hypothesis (EMH) to begin unravelling, this actually occurred in the 1980s. Read More..

Up until the 1980s the dominant theory was that financial markets were efficient – in other words all relevant information was reflected in asset prices in a rational manner. While some think it was the Global Financial Crisis that caused faith in the so-called Efficient Markets Hypothesis (EMH) to begin unravelling, this actually occurred in the 1980s. Read More..

Shane Oliver Updates: Investment cycles – why investors need to be aware and wary of them

11 August 2022

Cycles are part of life. Whether it be the cycle of day and night, seasons, tides, weather cycles from the almost weekly cycles of cold fronts that regularly blow across southeast Australia to the longer La Nina and El Nino cycles, fertility cycles, birth and death, etc. And so, cycles are also endemic to economies and investment markets. Read More..

Cycles are part of life. Whether it be the cycle of day and night, seasons, tides, weather cycles from the almost weekly cycles of cold fronts that regularly blow across southeast Australia to the longer La Nina and El Nino cycles, fertility cycles, birth and death, etc. And so, cycles are also endemic to economies and investment markets. Read More..

Shane Oliver Updates: Five reasons why the RBA cash rate is likely to peak (or should peak) with a 2 in front of it rather than a 3 (or more)

3 August 2022

As widely expected, the RBA has increased the cash rate again by 0.5% taking it to 1.85%. This is more than double the 0.75% rate that applied before the pandemic started. The 175 basis points in rate hikes since April is the fastest back-to-back series of rate hikes since increases of 0.25%, 0.75% and 1% in October... Read More..

As widely expected, the RBA has increased the cash rate again by 0.5% taking it to 1.85%. This is more than double the 0.75% rate that applied before the pandemic started. The 175 basis points in rate hikes since April is the fastest back-to-back series of rate hikes since increases of 0.25%, 0.75% and 1% in October... Read More..

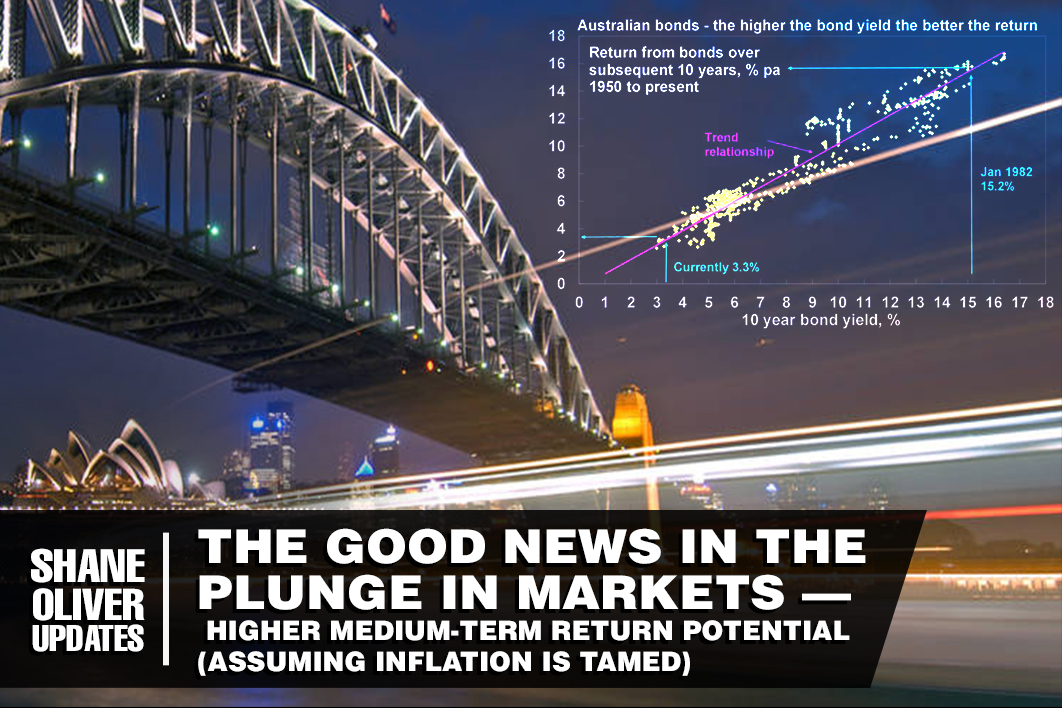

The good news in the plunge in markets – higher medium-term return potential (assuming inflation is tamed)

28 July 2022

The start of this year has been painful for investors with sharp losses in shares and bonds, dragging most superannuation funds into negative returns for the last financial year. And yet despite this setback and rough patches in 2015, 2018 and in early 2020 with pandemic lockdowns... Read More..

The start of this year has been painful for investors with sharp losses in shares and bonds, dragging most superannuation funds into negative returns for the last financial year. And yet despite this setback and rough patches in 2015, 2018 and in early 2020 with pandemic lockdowns... Read More..

The plunge in shares & flow on to super - key things for investors to keep in mind during times of market turmoil

22 June 2022

Usually share markets are relatively calm and so don’t generate a lot of attention. But periodically they tumble and generate headlines like “billions wiped off share market” & “biggest share plunge since…” Sometimes it ends quickly and the market heads back up again and is forgotten about. But once every so often share markets keep falling for a while. Read More..

Usually share markets are relatively calm and so don’t generate a lot of attention. But periodically they tumble and generate headlines like “billions wiped off share market” & “biggest share plunge since…” Sometimes it ends quickly and the market heads back up again and is forgotten about. But once every so often share markets keep falling for a while. Read More..

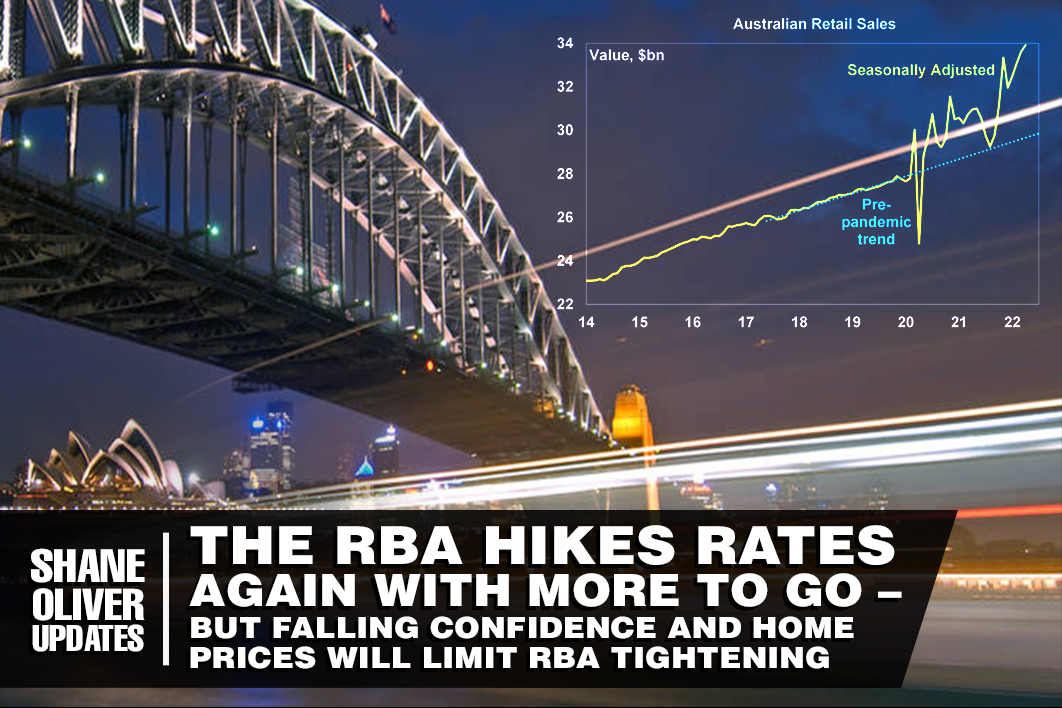

Shane Oliver Updates: The RBA hikes rates again with more to go – but falling confidence and home prices will limit RBA tightening

9 June 2022

The RBA has increased its official cash rate by another 0.5% taking it to 0.85% for the second rate hike in this cycle. This was above market expectations. Our expectation was for a 0.4% hike with the risk that it would be 0.5%. In justifying the move the RBA noted that: the economy is resilient; the labour market is strong with... Read More..

The RBA has increased its official cash rate by another 0.5% taking it to 0.85% for the second rate hike in this cycle. This was above market expectations. Our expectation was for a 0.4% hike with the risk that it would be 0.5%. In justifying the move the RBA noted that: the economy is resilient; the labour market is strong with... Read More..

Shane Oliver Updates: National Property Prices Fall For The First Time Since The Pandemic – Expect A 10-15% Top To Bottom Fall

3 June 2022

After a massive 28.6% gain from their pandemic low – which was the biggest gain over 21 months since 2003 – national average home prices fell for the first time in May since September 2020 based on CoreLogic data. While national average dwelling prices fell 0.1%, they were led by falls of 1% in Sydney and 0.7% in Melbourne. Read More..

After a massive 28.6% gain from their pandemic low – which was the biggest gain over 21 months since 2003 – national average home prices fell for the first time in May since September 2020 based on CoreLogic data. While national average dwelling prices fell 0.1%, they were led by falls of 1% in Sydney and 0.7% in Melbourne. Read More..

Changes Coming To Your Superannuation From 1 July 2022

29 May 2022

TFor Many, The Concept Of Superannuation Can Be Drier Than The Mojave Desert. But That’s Where Appearances Can Be Deceiving. Superannuation is a versatile investment vehicle – there are a myriad of ways to contribute, receive contributions, or do both! Aside from creating a future benefit in the form of retirement savings, making a personal... Read More..

TFor Many, The Concept Of Superannuation Can Be Drier Than The Mojave Desert. But That’s Where Appearances Can Be Deceiving. Superannuation is a versatile investment vehicle – there are a myriad of ways to contribute, receive contributions, or do both! Aside from creating a future benefit in the form of retirement savings, making a personal... Read More..

Shane Oliver Updates: Australia’s new Government – what does it mean for investors?

26 May 2022

The ALP won the election and is set to Govern most likely in its in own right or as a minority government. Following its loss in the 2019 election which was partly blamed on a “radical” tax & spend agenda, the ALP adopted a “small target” approach this time, so its economic policies are not significantly different to those of the outgoing Coalition Government. Read More..

The ALP won the election and is set to Govern most likely in its in own right or as a minority government. Following its loss in the 2019 election which was partly blamed on a “radical” tax & spend agenda, the ALP adopted a “small target” approach this time, so its economic policies are not significantly different to those of the outgoing Coalition Government. Read More..

Shane Oliver Updates: The Falls In Share Markets This Year – The Bad News And The Good

19 May 2022

Last year saw very strong investment returns and was relatively calm in investment markets. While there was a lot to worry about, the biggest drawdown in US shares was 5% and in Australian shares it was 6%. This always seemed unlikely to be repeated and it certainly hasn’t been so far in 2022! While they have had a good bounce from last week’s lows...Read More..

Last year saw very strong investment returns and was relatively calm in investment markets. While there was a lot to worry about, the biggest drawdown in US shares was 5% and in Australian shares it was 6%. This always seemed unlikely to be repeated and it certainly hasn’t been so far in 2022! While they have had a good bounce from last week’s lows...Read More..

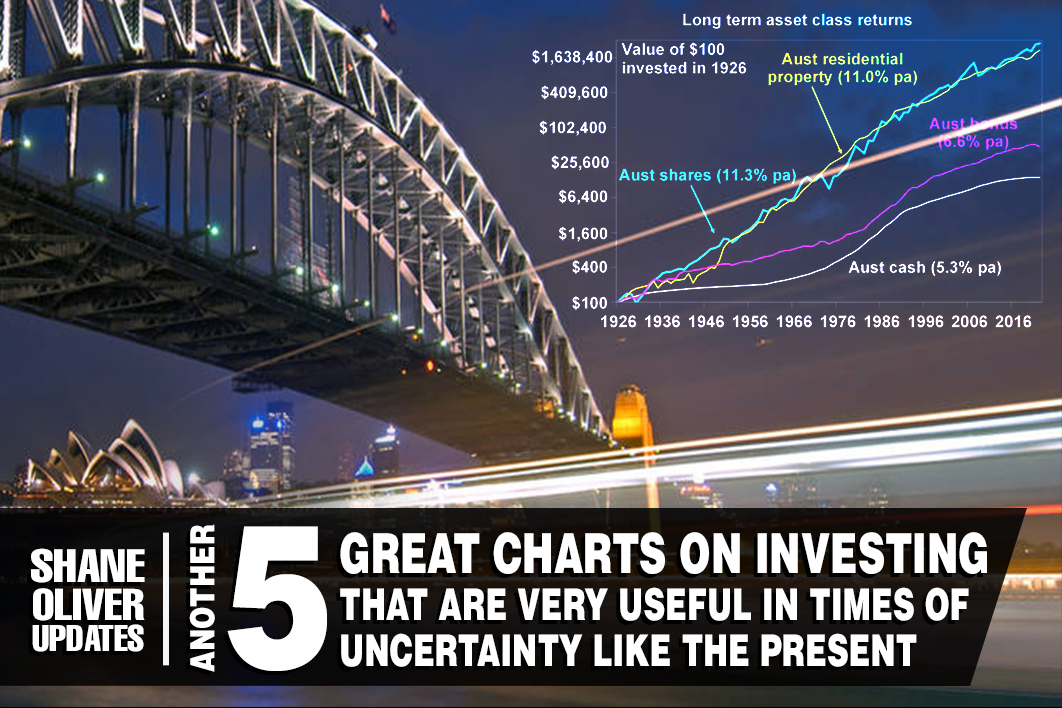

Shane Oliver Updates: Another Five Great Charts On Investing That Are Very Useful In Times Of Uncertainty Like The Present

16 May 2022

Successful investing can be really hard in times like the present when share markets are down sharply & very volatile on the back of uncertainty around inflation, rising interest rates and the war in Ukraine. I will be the first to admit that my crystal ball is even hazier than normal in times like the present. As the US economist JK Galbraith once said “there are two types of economists – those that don’t know and those that don’t know they don’t know.” Read More..

Successful investing can be really hard in times like the present when share markets are down sharply & very volatile on the back of uncertainty around inflation, rising interest rates and the war in Ukraine. I will be the first to admit that my crystal ball is even hazier than normal in times like the present. As the US economist JK Galbraith once said “there are two types of economists – those that don’t know and those that don’t know they don’t know.” Read More..

Shane Oliver Updates: The RBA Starts Raising Rates – How Far And How Fast? And What Does It Mean For Investors?

4 May 2022

For the first time since November 2010, the RBA has raised its official cash rate - from 0.1% taking it to 0.35%. This was above market expectations for a 0.15% hike and a bit closer to our expectation for a 0.4% move suggesting that the RBA appears to have partly accepted the argument that it had to do something decisive in order signal its resolve to get inflation back down. Read More..

For the first time since November 2010, the RBA has raised its official cash rate - from 0.1% taking it to 0.35%. This was above market expectations for a 0.15% hike and a bit closer to our expectation for a 0.4% move suggesting that the RBA appears to have partly accepted the argument that it had to do something decisive in order signal its resolve to get inflation back down. Read More..

Shane Oliver Updates: Australian housing slowdown Q&A – What impact will higher interest rates have? How far will prices fall?

20 April 2022

House prices always incite a lot of interest in Australia. Until recently it was all about surging prices and ever worsening affordability as prices boomed. But the focus is shifting to the emerging slowdown in the face of rising interest rates. This note provides a Q&A on the main issues. Read More..

House prices always incite a lot of interest in Australia. Until recently it was all about surging prices and ever worsening affordability as prices boomed. But the focus is shifting to the emerging slowdown in the face of rising interest rates. This note provides a Q&A on the main issues. Read More..

Shane Oliver Updates: Five Great Charts On Investing That Are Particularly Useful In Times Of Uncertainty Like The Present

11 August 2021

Investing is often seen as complicated. This has been made worse over the years by: the increasing complexity in terms of investment products and choices; regulations and rules around investing; the role of the information revolution and social media in amplifying the noise around investment markets; and the expanding ways available to access and transact in various investments. Read More..

Investing is often seen as complicated. This has been made worse over the years by: the increasing complexity in terms of investment products and choices; regulations and rules around investing; the role of the information revolution and social media in amplifying the noise around investment markets; and the expanding ways available to access and transact in various investments. Read More..

Shane Oliver Updates: The 2022-23 Australian Budget – a “magic election pudding” of more spending and lower deficits

30 March 2022

The 2022-23 Budget provides a “magic election pudding” of more spending but lower deficits. The additional spending relates mainly to this calendar year and given the strong economy is more motivated by politics than economics. “Fiscal repair” kicks in for the medium-term but this takes the form of restrained spending growth in contrast to the last two budgets rather than austerity. Read More..

The 2022-23 Budget provides a “magic election pudding” of more spending but lower deficits. The additional spending relates mainly to this calendar year and given the strong economy is more motivated by politics than economics. “Fiscal repair” kicks in for the medium-term but this takes the form of restrained spending growth in contrast to the last two budgets rather than austerity. Read More..

Shane Oliver Updates: Five Big Picture Implications Of The War In Ukraine Of Relevance For Investors – And Why Are Australian Shares Holding Up Better?

7 March 2022

Humans do horrible things to each other, and war is the worst example of that. What was first announced by Russia earlier last week as a “peacekeeping” force moving into part of eastern Ukraine controlled by Russian separatists quickly morphed into a full-blown attack. This in turn has seen a progressive ramping up in western sanctions on Russia. Read More..

Humans do horrible things to each other, and war is the worst example of that. What was first announced by Russia earlier last week as a “peacekeeping” force moving into part of eastern Ukraine controlled by Russian separatists quickly morphed into a full-blown attack. This in turn has seen a progressive ramping up in western sanctions on Russia. Read More..

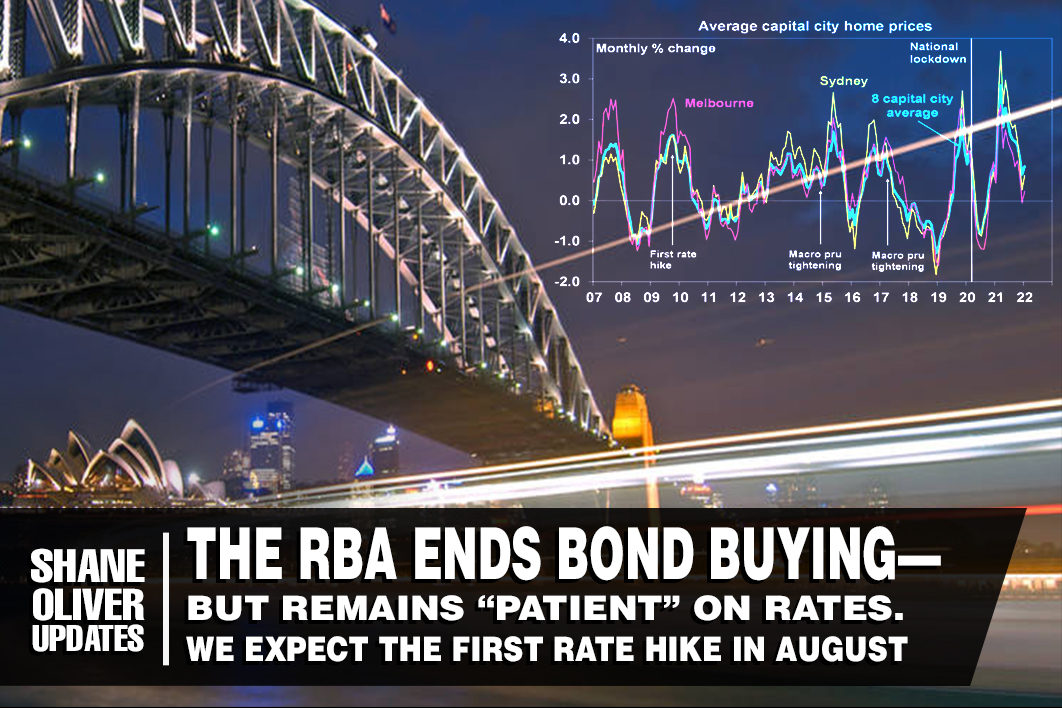

Shane Oliver Updates: The RBA Ends Bond Buying – But Remains “Patient” On Rates. We Expect The First Rate Hike In August

4 February 2022

Over the last six months several central banks have raised interest rates. This started in emerging markets but developed country central banks have also hiked rates - notably those in the UK, NZ, Norway and South Korea. Both the Fed and Bank of Canada are likely to hike in March. And now the RBA is (slowly) getting closer to rate hikes too. Last year it ended cheap funding for banks in June, slowed its bond buying and in November ended its... Read More..

Over the last six months several central banks have raised interest rates. This started in emerging markets but developed country central banks have also hiked rates - notably those in the UK, NZ, Norway and South Korea. Both the Fed and Bank of Canada are likely to hike in March. And now the RBA is (slowly) getting closer to rate hikes too. Last year it ended cheap funding for banks in June, slowed its bond buying and in November ended its... Read More..

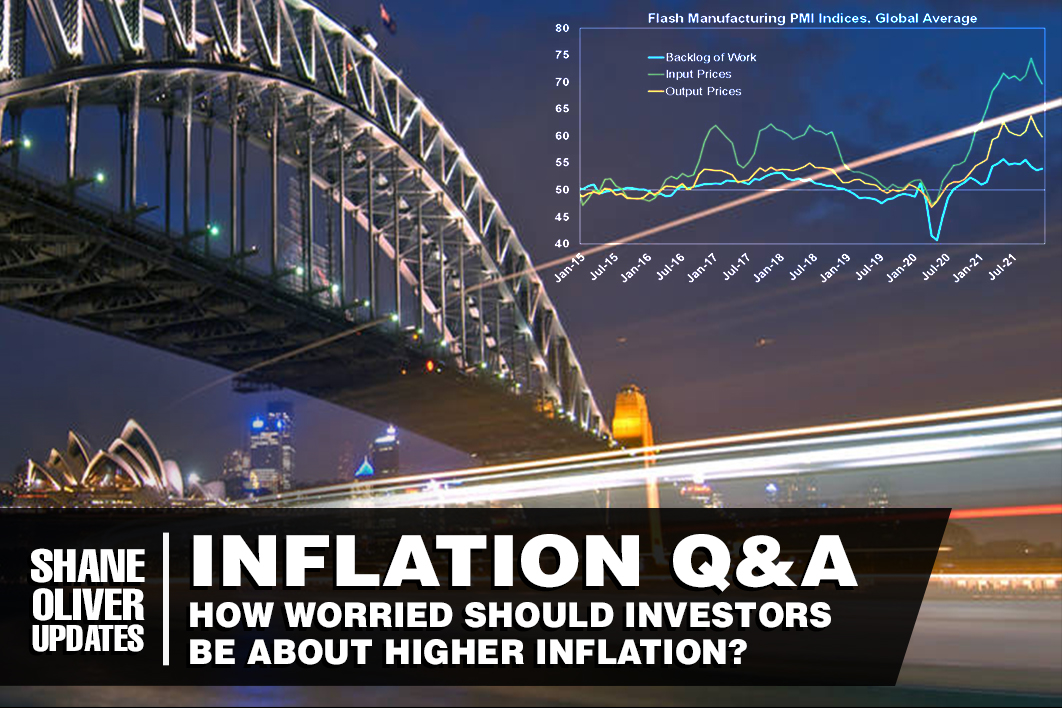

Shane Oliver Updates: Inflation Q&A – How Worried Should Investors Be About Higher Inflation?

20 January 2022

For last few decades inflation has not been much of an issue. It was all about economic activity. Books were even written about “the death of inflation”. In fact, for much of the post GFC period inflation in many countries was below central bank targets and all the talk was of “secular stagnation” and disinflation with a fear of deflation. Read More..

For last few decades inflation has not been much of an issue. It was all about economic activity. Books were even written about “the death of inflation”. In fact, for much of the post GFC period inflation in many countries was below central bank targets and all the talk was of “secular stagnation” and disinflation with a fear of deflation. Read More..

Shane Oliver Updates: 2022 – A List Of Lists Regarding The Macro Investment Outlook

13 January 2022

Despite a wall of worry with coronavirus and inflation, 2021 was a great year for diversified investors, with average balanced growth super funds looking like they have returned around 14%, after just 3.6% in 2020. Balanced growth super fund returns have averaged around 8.5%pa over the last five years, well above inflation and bank deposit rates. Read More..

Despite a wall of worry with coronavirus and inflation, 2021 was a great year for diversified investors, with average balanced growth super funds looking like they have returned around 14%, after just 3.6% in 2020. Balanced growth super fund returns have averaged around 8.5%pa over the last five years, well above inflation and bank deposit rates. Read More..

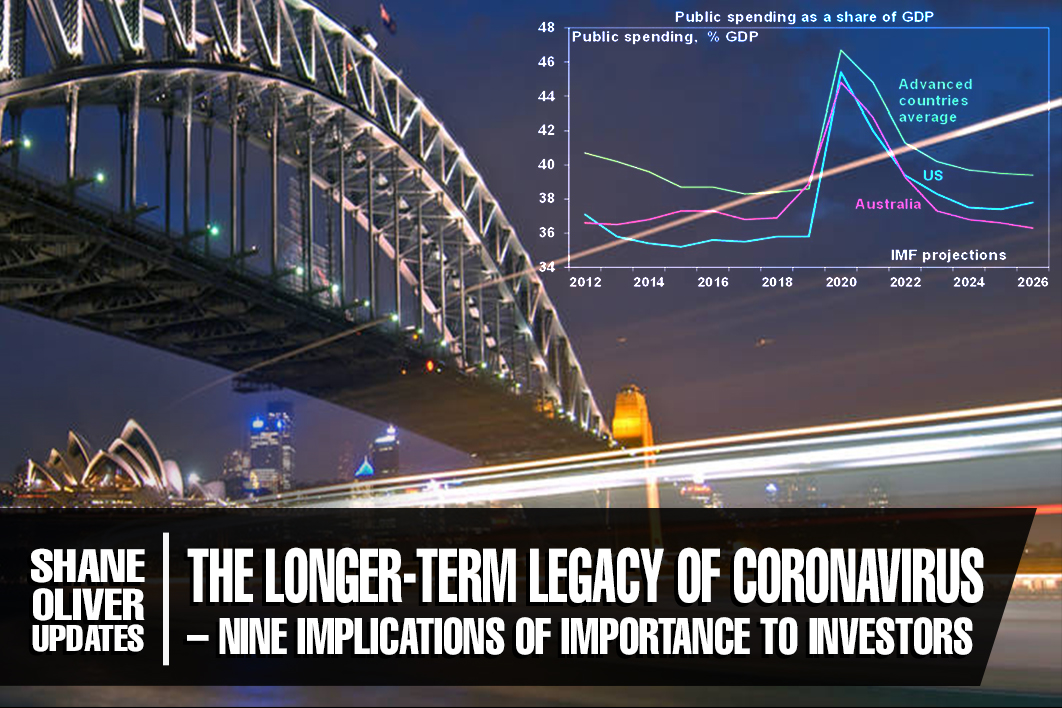

Shane Oliver Updates: The Longer-Term Legacy Of Coronavirus – Nine Implications Of Importance To Investors

29 November 2021

The magnitude of the coronavirus shock means it will have implications beyond those associated with its short-term economic disruption. But the key is that vaccines and new treatments provide a path out of the pandemic and long hard lockdowns and as a result it’s likely that 2022 will be the year we will “learn to live with covid” and it goes from being an epidemic to being endemic. So it makes sense to have a look at what its longer term legacy may be. Here are 9 key medium to longer term impacts. Read More..

The magnitude of the coronavirus shock means it will have implications beyond those associated with its short-term economic disruption. But the key is that vaccines and new treatments provide a path out of the pandemic and long hard lockdowns and as a result it’s likely that 2022 will be the year we will “learn to live with covid” and it goes from being an epidemic to being endemic. So it makes sense to have a look at what its longer term legacy may be. Here are 9 key medium to longer term impacts. Read More..

Shane Oliver Updates: Compound Interest Is Like Magic – And It’s An Investor’s Best Friend

11 November 2021

If there is one “technical thing” investors should know about investing, it’s the power of compound interest. In the rush to understand short-term developments impacting investment markets regarding the economy, interest rates, profits, politics, etc, and in recent times coronavirus its often forgotten about. Read More..

If there is one “technical thing” investors should know about investing, it’s the power of compound interest. In the rush to understand short-term developments impacting investment markets regarding the economy, interest rates, profits, politics, etc, and in recent times coronavirus its often forgotten about. Read More..

BetaShares Updates: Forget Nukes – Cyber Conflict Is The 21st Century Crisis

15 October 2021

The online age has heralded a new era of warfare, which pits not only sovereign nations against one another, but also cyber criminals against businesses, individuals, and their intellectual property. Cybersecurity incidents soared in Australia during the past financial year, according to the recent Australian Cyber Security Centre’s (ACSC) second annual threat report. Read More..

The online age has heralded a new era of warfare, which pits not only sovereign nations against one another, but also cyber criminals against businesses, individuals, and their intellectual property. Cybersecurity incidents soared in Australia during the past financial year, according to the recent Australian Cyber Security Centre’s (ACSC) second annual threat report. Read More..

Shane Oliver Updates: The worry list for shares – how worrying are they?

14 October 2021

September was a poor month for shares with global shares losing 3.7% in local currency terms and Australian shares losing 2.7%. It’s possible that following top to bottom falls of 5-6% in global and Australian shares we have now seen the low. But it’s impossible to be definitive, and with the worry list around US fiscal policy, China, energy, supply bottlenecks and inflation, central bank hawkishness and ongoing risks around coronavirus... Read More..

September was a poor month for shares with global shares losing 3.7% in local currency terms and Australian shares losing 2.7%. It’s possible that following top to bottom falls of 5-6% in global and Australian shares we have now seen the low. But it’s impossible to be definitive, and with the worry list around US fiscal policy, China, energy, supply bottlenecks and inflation, central bank hawkishness and ongoing risks around coronavirus... Read More..

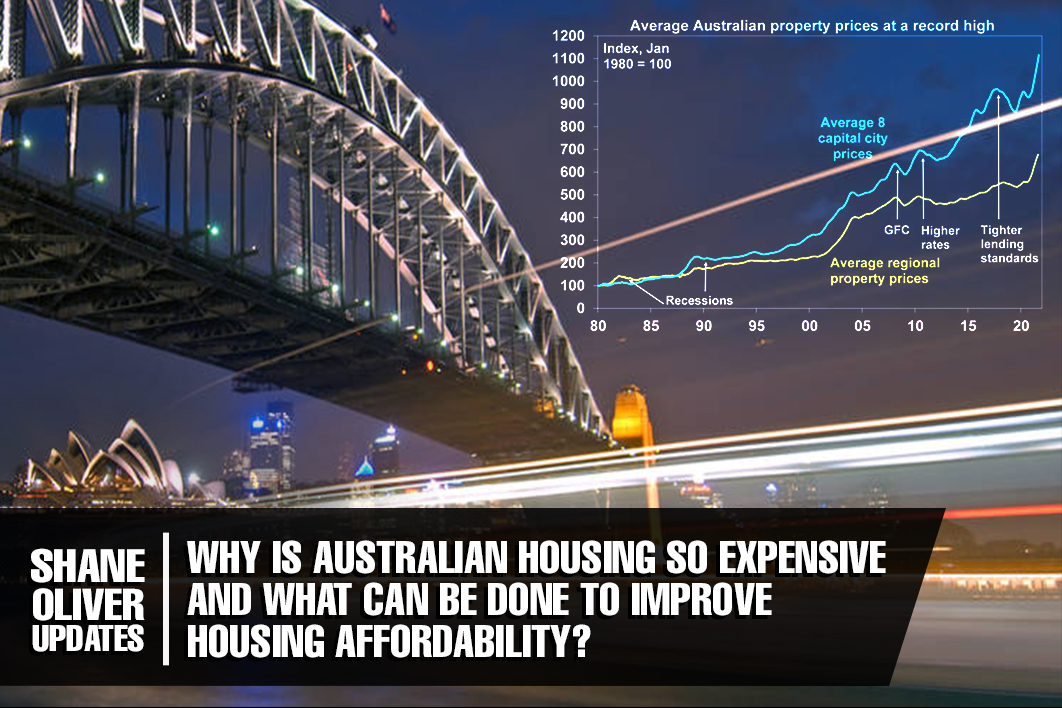

Shane Oliver Updates: Why Is Australian Housing So Expensive And What Can Be Done To Improve Housing Affordability?

30 September 2021

For as long as I can recall housing affordability has been an issue in Australia but since the 1990s it’s gone from being a periodic cyclical concern to a chronic problem. The 20% rise in prices over the last year has put the spotlight on the issue again. With the surge in house prices since the 1990s has come a surge in debt which brings with it the risk of financial instability should something go wrong in the ability of borrowers to service that debt. Read More..

For as long as I can recall housing affordability has been an issue in Australia but since the 1990s it’s gone from being a periodic cyclical concern to a chronic problem. The 20% rise in prices over the last year has put the spotlight on the issue again. With the surge in house prices since the 1990s has come a surge in debt which brings with it the risk of financial instability should something go wrong in the ability of borrowers to service that debt. Read More..

Shane Oliver Updates: Five reasons why the Australian dollar is likely to resume its upswing over the next 12 months

16 September 2021

Movements in the value of the Australian dollar are important for Australian-based investors in that they directly impact the value of (and hence returns from) international investments and indirectly effect the performance of domestic assets like shares via the impact on Australia’s competitiveness. But currency movements are also one of the hardest things to get right. This year has been no exception with the $A initially surging to $US0.80 in February... Read More..

Movements in the value of the Australian dollar are important for Australian-based investors in that they directly impact the value of (and hence returns from) international investments and indirectly effect the performance of domestic assets like shares via the impact on Australia’s competitiveness. But currency movements are also one of the hardest things to get right. This year has been no exception with the $A initially surging to $US0.80 in February... Read More..

Shane Oliver Updates: Australian GDP slowed in the June quarter & will be hit hard by the lockdowns - but here’s 7 reasons to look beyond the gloom

2 September 2021

Three months ago there was much optimism about the Australian economic outlook. GDP regained its pre pandemic level, confidence was strong, the jobs market was roaring, there was minimal community coronavirus & vaccines were providing optimism of a more sustained reopening. Since then renewed coronavirus outbreaks of the Delta variant have seen the near-term outlook turn pear shaped – notably in NSW & Victoria. Read More..

Three months ago there was much optimism about the Australian economic outlook. GDP regained its pre pandemic level, confidence was strong, the jobs market was roaring, there was minimal community coronavirus & vaccines were providing optimism of a more sustained reopening. Since then renewed coronavirus outbreaks of the Delta variant have seen the near-term outlook turn pear shaped – notably in NSW & Victoria. Read More..

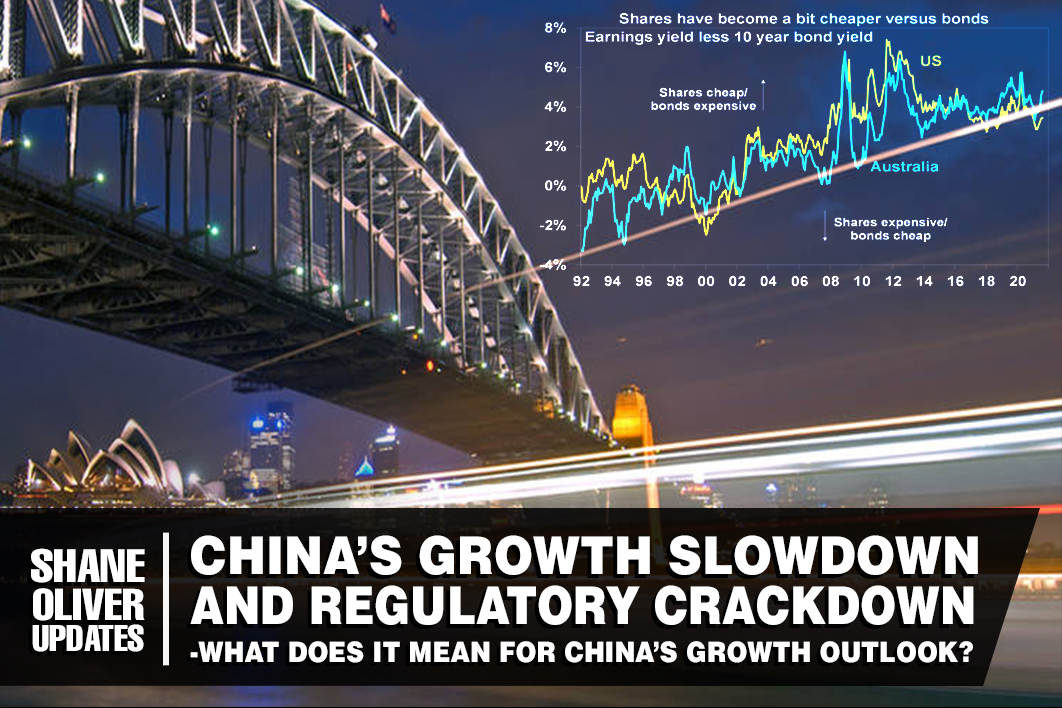

Shane Oliver Updates: China’s growth slowdown and regulatory crackdown – what does it mean for China’s growth outlook?

27 August 2021

After surging 65% from its coronavirus low in March 2020 to its high in February this year, the Chinese share market saw an 18% decline into July. This reflected concerns about policy tightening, the economic outlook and a regulatory crackdown on a range of industries, notably tech stocks and steel production, with the latter contributing to a plunge in the iron ore price. Read More..

After surging 65% from its coronavirus low in March 2020 to its high in February this year, the Chinese share market saw an 18% decline into July. This reflected concerns about policy tightening, the economic outlook and a regulatory crackdown on a range of industries, notably tech stocks and steel production, with the latter contributing to a plunge in the iron ore price. Read More..

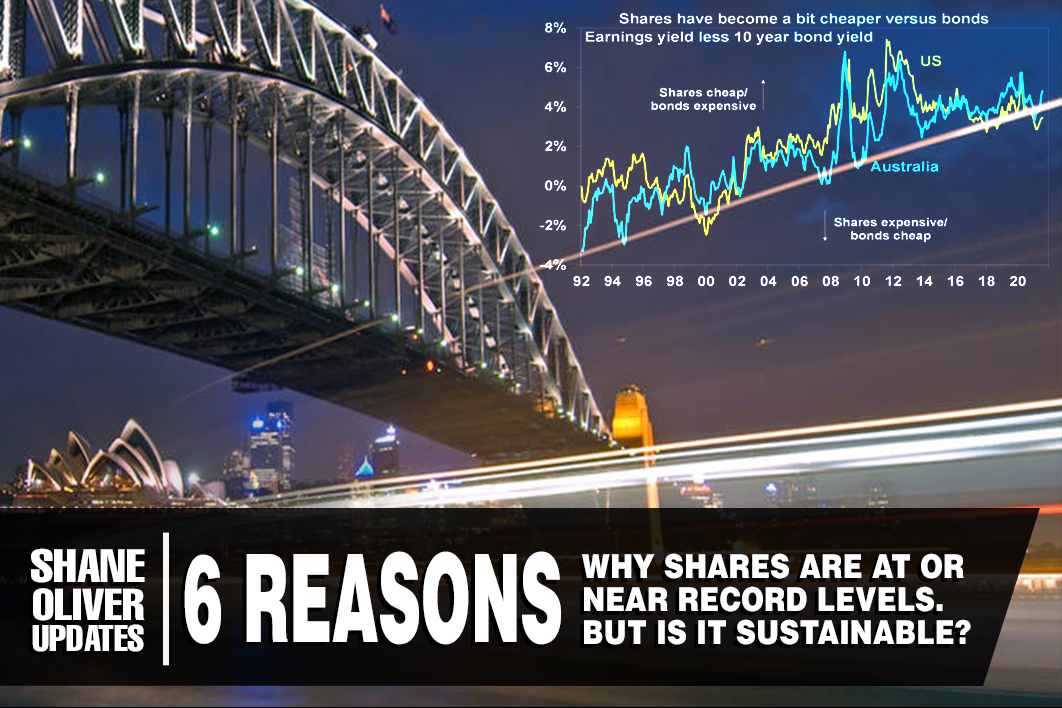

Shane Oliver Updates: Six reasons why shares are at or near record levels. But is it sustainable?

18 August 2021

Despite lots of worries – around the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus and high inflation – global and Australian shares are around record levels. So how can this be? Particularly with bond yields down sharply from their highs earlier this year. And how sustainable is it? And what are the risks? Read More..

Despite lots of worries – around the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus and high inflation – global and Australian shares are around record levels. So how can this be? Particularly with bond yields down sharply from their highs earlier this year. And how sustainable is it? And what are the risks? Read More..

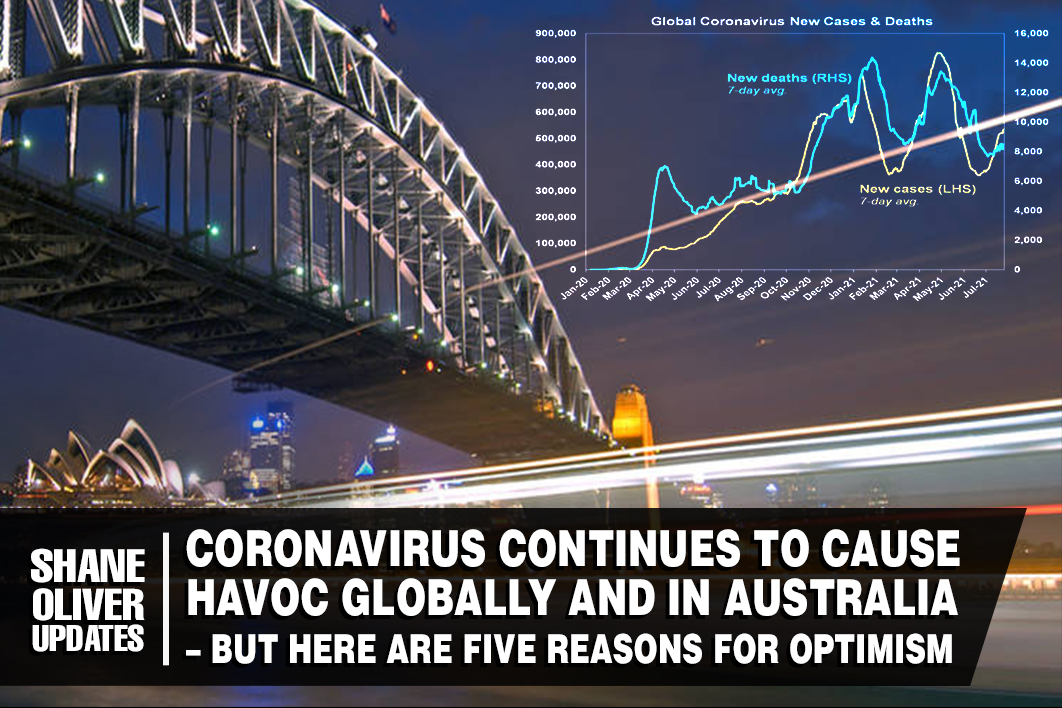

Shane Oliver Updates: Coronavirus Continues To Cause Havoc Globally And In Australia – But Here Are Five Reasons For Optimism

18 August 2021

The news on coronavirus has been bleak again lately – with rising cases globally & the ongoing NSW lockdown. However, there are five reasons for optimism: lockdowns still work against Delta (eg, in SA & Victoria); vaccines are working; once lockdowns end economic activity rebounds quickly; the threat posed by Delta will keep fiscal & monetary policy easier for longer; and vaccinations are ramping up in Australia. Read More..

The news on coronavirus has been bleak again lately – with rising cases globally & the ongoing NSW lockdown. However, there are five reasons for optimism: lockdowns still work against Delta (eg, in SA & Victoria); vaccines are working; once lockdowns end economic activity rebounds quickly; the threat posed by Delta will keep fiscal & monetary policy easier for longer; and vaccinations are ramping up in Australia. Read More..

Shane Oliver Updates: Great Investment Quotes For Topsy Turvy Times

11 August 2021

The current environment seems to be one of extreme uncertainty. We have seen a strong economic recovery from last year’s global and Australian recessions – but there are worries about the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus, high inflation, and high debt levels. Read More..

The current environment seems to be one of extreme uncertainty. We have seen a strong economic recovery from last year’s global and Australian recessions – but there are worries about the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus, high inflation, and high debt levels. Read More..

Shane Oliver Updates: Seven Key Charts For Investors To Watch – Where Are They Now?

23 July 2021

While shares are at risk of a near term correction on the back of coronavirus and inflation concerns, the trend is likely to remain up against the backdrop of continuing economic recovery and low interest rates. This note takes a look at seven charts we highlighted in January for investors to watch as being critical to the investment outlook this year. Put simply, where are they now?. Read More..

While shares are at risk of a near term correction on the back of coronavirus and inflation concerns, the trend is likely to remain up against the backdrop of continuing economic recovery and low interest rates. This note takes a look at seven charts we highlighted in January for investors to watch as being critical to the investment outlook this year. Put simply, where are they now?. Read More..

2020-21 saw investment returns rebound – expect more modest but still good returns this financial year

8 July 2021

The past financial year saw a spectacular rebound in returns for investors as the focus shifted from the recession to recovery against a backdrop of policy stimulus and vaccines. This note reviews the last financial year and takes a look at the outlook. Read More..

The past financial year saw a spectacular rebound in returns for investors as the focus shifted from the recession to recovery against a backdrop of policy stimulus and vaccines. This note reviews the last financial year and takes a look at the outlook. Read More..

Macquarie Wealth Management: 05 July 2021 Research - The Financial Year That Was: Better Than Expected ... And Likely To Continue

5 July 2021

The global and domestic economies recovered much faster than expected through fiscal 2021, driven by unprecedented monetary and fiscal policy supports, a faster than expected re-opening of economies, earlier than expected vaccine rollouts, the release of pent-up demand and (surprisingly) resilient business and consumer confidence, which supported a sharp rebound in hiring, investment and spending once social restrictions were relaxed. Read More..

The global and domestic economies recovered much faster than expected through fiscal 2021, driven by unprecedented monetary and fiscal policy supports, a faster than expected re-opening of economies, earlier than expected vaccine rollouts, the release of pent-up demand and (surprisingly) resilient business and consumer confidence, which supported a sharp rebound in hiring, investment and spending once social restrictions were relaxed. Read More..

Shane Oliver Updates: Inflation – why it matters for investment markets

10 June 2021

There has been much concern about inflation this year – but why should it matter for growth assets like shares and property? Surely earnings and rents will just go up with higher inflation offsetting any negative impact from higher interest rates due to higher inflation? In reality, it’s more complicated. This note takes a closer look at the impact of inflation on growth assets like shares and property. Read More..

There has been much concern about inflation this year – but why should it matter for growth assets like shares and property? Surely earnings and rents will just go up with higher inflation offsetting any negative impact from higher interest rates due to higher inflation? In reality, it’s more complicated. This note takes a closer look at the impact of inflation on growth assets like shares and property. Read More..

Shane Oliver Updates: Big-spending Federal Budget set to spur on the recovery

19 May 2021

The 2021 Federal Budget harks back to the immediate post GFC budgets in some ways, with the Treasurer resisting any temptation to start early on the task of budget repair and doubling down on stimulus. The government has announced $96 billion of extra spending over the next four years, but the run of deficits will still be lower than was predicted last October, making this a bit of a “have your cake and eat it too” budget. Read More..

The 2021 Federal Budget harks back to the immediate post GFC budgets in some ways, with the Treasurer resisting any temptation to start early on the task of budget repair and doubling down on stimulus. The government has announced $96 billion of extra spending over the next four years, but the run of deficits will still be lower than was predicted last October, making this a bit of a “have your cake and eat it too” budget. Read More..

Shane Oliver Updates: The 2021-22 Australian Budget – Spending The Growth Windfall To Further Grow The Economy Towards Full Employment

13 May 2021

The 2021-22 Budget sees the Government ditch its plan to start budget repair (or austerity) once unemployment is “comfortably below 6%” in favour of continuing to focus on growing the economy to drive full employment and, in doing so, repair the budget that way. As a result, the Budget provides more stimulus and, thanks to the stronger economic recovery and high iron ore prices, is still able to report a declining deficit. Read More..

The 2021-22 Budget sees the Government ditch its plan to start budget repair (or austerity) once unemployment is “comfortably below 6%” in favour of continuing to focus on growing the economy to drive full employment and, in doing so, repair the budget that way. As a result, the Budget provides more stimulus and, thanks to the stronger economic recovery and high iron ore prices, is still able to report a declining deficit. Read More..

Centrepoint Alliance: 2021 Federal Budget Summary

12 May 2021

It seems like no time has passed since the last Federal Budget. In many ways, that is correct. As a result of the COVID-19 pandemic, the 2020 Budget was delayed until October 2020. And what a year it has been. The 2021 Budget, brought down on 11 May 2021, may well be the last Budget before the next Federal Election is held. With the next Federal Election due to be held sometime between August 2021 and May 2022, the Budget includes a number of “sweeteners’ to keep the electorate favourably disposed towards the incumbent government. Read More..

It seems like no time has passed since the last Federal Budget. In many ways, that is correct. As a result of the COVID-19 pandemic, the 2020 Budget was delayed until October 2020. And what a year it has been. The 2021 Budget, brought down on 11 May 2021, may well be the last Budget before the next Federal Election is held. With the next Federal Election due to be held sometime between August 2021 and May 2022, the Budget includes a number of “sweeteners’ to keep the electorate favourably disposed towards the incumbent government. Read More..

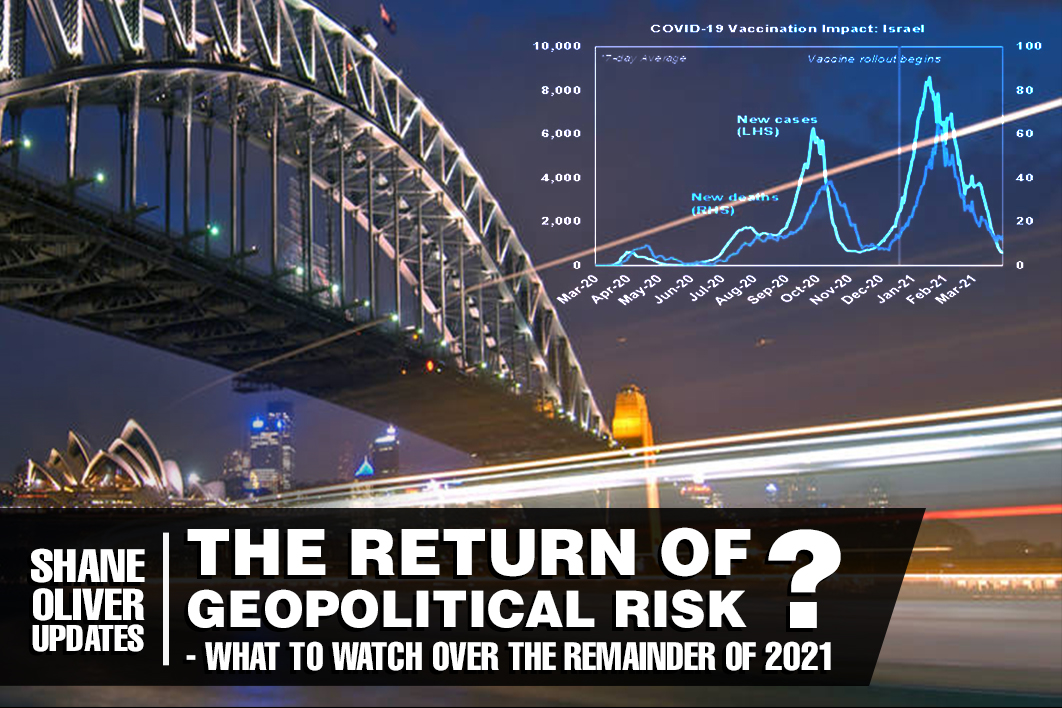

Shane Oliver Updates: The Return Of Geopolitical Risk? – What To Watch Over The Remainder Of 2021

6 May 2021

Over the last decade or so it seems geopolitical risk has become of greater significance for investors – particularly with the 2016 Brexit vote and Donald Trump’s election, and tensions with China from 2018. However, beyond lots of noise around President Trump and the US election, geopolitical risk took a back seat for most of the last year in terms of relevance for global investment markets as coronavirus dominated. Read More..

Over the last decade or so it seems geopolitical risk has become of greater significance for investors – particularly with the 2016 Brexit vote and Donald Trump’s election, and tensions with China from 2018. However, beyond lots of noise around President Trump and the US election, geopolitical risk took a back seat for most of the last year in terms of relevance for global investment markets as coronavirus dominated. Read More..

Shane Oliver Updates: Four Factors - Besides Interest Rates - That Will Shape The Outlook For House Prices

13 April 2021

Average dwelling prices in Australian capital cities rose by 2.8% in March, their seventh consecutive monthly gain and the largest in more than 30 years. Prices are now up by 3.5% on previous record highs and almost 5% on pre-pandemic levels. Homeowners across the country are sharing in the good fortune, with Perth and Darwin the only two cities where residential property prices have not recently surpassed their previous high-water marks.. Read More..

Average dwelling prices in Australian capital cities rose by 2.8% in March, their seventh consecutive monthly gain and the largest in more than 30 years. Prices are now up by 3.5% on previous record highs and almost 5% on pre-pandemic levels. Homeowners across the country are sharing in the good fortune, with Perth and Darwin the only two cities where residential property prices have not recently surpassed their previous high-water marks.. Read More..

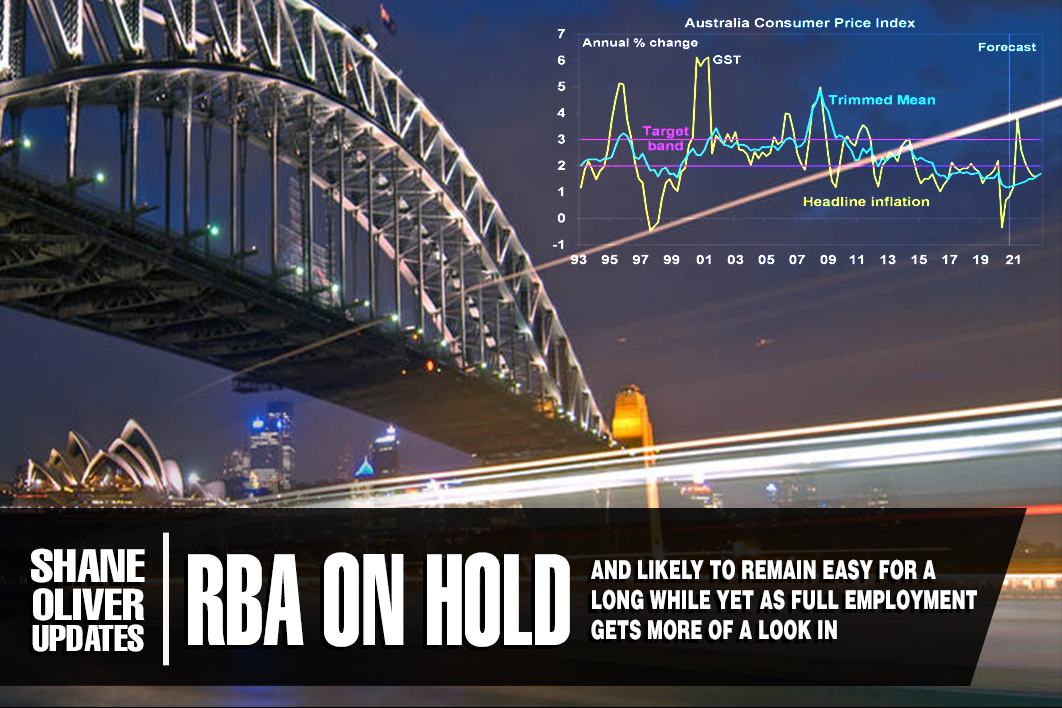

Shane Oliver Updates: RBA on hold and likely to remain easy for a long while yet as full employment gets more of a look in

8 April 2021

It’s been more than a year since the RBA started using a range of unconventional monetary policies in response to the impact on the economy of the pandemic driven lockdowns and we are now seeing a strong recovery. Normally the RBA might now be starting to contemplate rate hikes for some time in the next year but their operating function is now very different to that seen prior to the pandemic. Read More..

It’s been more than a year since the RBA started using a range of unconventional monetary policies in response to the impact on the economy of the pandemic driven lockdowns and we are now seeing a strong recovery. Normally the RBA might now be starting to contemplate rate hikes for some time in the next year but their operating function is now very different to that seen prior to the pandemic. Read More..

Shane Oliver Updates: Market Outlook Q&A – Global Recovery, Vaccines, Inflation, The Risk Of A Share Crash, Aust House Prices And Other Issues

1 April 2021

This note covers the main questions investors commonly have regarding the investment outlook in a simple Q&A format. From topics on global recovery, vaccines, to Australia's recovery, tensions with China, and, how Australian house prices are booming again. Read More..

This note covers the main questions investors commonly have regarding the investment outlook in a simple Q&A format. From topics on global recovery, vaccines, to Australia's recovery, tensions with China, and, how Australian house prices are booming again. Read More..

Macquarie Wealth Management: 1 March 2021 Investment Strategy Update: Temporary Turbulence

1 March 2021

Heading into the new year we expected to see a strong growth rebound, the (re)emergence of some inflation, a rise in bond yields and for last year’s winners to become this year’s losers, as investors rotated out of expensive/over-owned growth stocks into cheap/under-owned value and cyclicals. Read More..

Heading into the new year we expected to see a strong growth rebound, the (re)emergence of some inflation, a rise in bond yields and for last year’s winners to become this year’s losers, as investors rotated out of expensive/over-owned growth stocks into cheap/under-owned value and cyclicals. Read More..

Macquarie Wealth Management: 26 Feb 2021 Investment Strategy Update: Part 1- Why It Will Require More Than Just Rising Yields To Kill The Equity Bull Market

26 February 2021

There is an enormous focus on the recent rise in long bond yields and if/when they may start to undermine – even prick – the equity bull market. We do not pretend to know the bond yield level that will prove to be a tipping point for equities because in reality there is no magical level that moves the outlook from good to bad (on a consistent basis) as this is as much about the conditions that surround the move in the bond yield... Read More..

There is an enormous focus on the recent rise in long bond yields and if/when they may start to undermine – even prick – the equity bull market. We do not pretend to know the bond yield level that will prove to be a tipping point for equities because in reality there is no magical level that moves the outlook from good to bad (on a consistent basis) as this is as much about the conditions that surround the move in the bond yield... Read More..

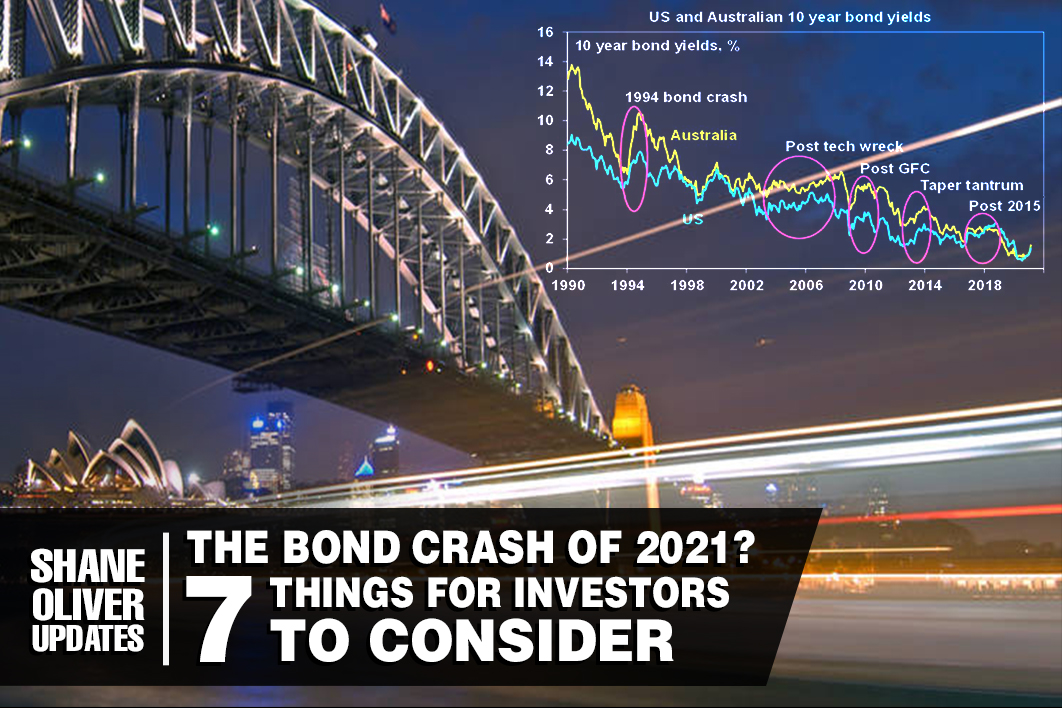

Shane Oliver Updates: The bond crash of 2021? Seven things for investors to consider

24 February 2020

The share market has been described by Warren Buffett as a “manic depressive”. The same can be said of financial markets generally I reckon, and it’s certainly been evident lately. Just a year ago investors were worried about depression and deflation with bond yields and share markets plunging and now they are worried about overheating and inflation with bond yields rising rapidly and causing agitation in share markets! Read More..

The share market has been described by Warren Buffett as a “manic depressive”. The same can be said of financial markets generally I reckon, and it’s certainly been evident lately. Just a year ago investors were worried about depression and deflation with bond yields and share markets plunging and now they are worried about overheating and inflation with bond yields rising rapidly and causing agitation in share markets! Read More..

Shane Oliver Updates: Australian house prices on the upswing again – seven things to bear in mind about the Australian property market

18 February 2021

After a 2.8% dip around mid-last year in response to the pandemic, average capital city home prices are rising again. Put simply - record low mortgage rates, multiple government home buyer incentives, government income support measures, pent up demand from the lockdowns, bank mortgage payment holidays, activity associated with a desire to “escape from the city”... Read More..

After a 2.8% dip around mid-last year in response to the pandemic, average capital city home prices are rising again. Put simply - record low mortgage rates, multiple government home buyer incentives, government income support measures, pent up demand from the lockdowns, bank mortgage payment holidays, activity associated with a desire to “escape from the city”... Read More..

Shane Oliver Updates: Nine Common Mistakes Investors Make

10 February 2021

In the confusing and often seemingly illogical world of investing, investors often make of bunch of mistakes that keeps them from reaching their financial goals. This note takes a look at the nine most common mistakes investors make. Read More..

In the confusing and often seemingly illogical world of investing, investors often make of bunch of mistakes that keeps them from reaching their financial goals. This note takes a look at the nine most common mistakes investors make. Read More..

Shane Oliver Updates: Seven key charts for investors to watch regarding the global economy and investment markets this year

29 January 2021

Our high-level investment view is that while shares are vulnerable to a short term correction having run up hard since early November, overall investment returns will be solid this year on the back of economic recovery (driven by stimulus and the deployment of vaccines allowing a more sustained reopening) at the same time that interest rates remain low. Read More..

Our high-level investment view is that while shares are vulnerable to a short term correction having run up hard since early November, overall investment returns will be solid this year on the back of economic recovery (driven by stimulus and the deployment of vaccines allowing a more sustained reopening) at the same time that interest rates remain low. Read More..

Shane Oliver Updates: 2021 - A List Of Lists Regarding The Macro Investment Outlook

13 January 2021

2020 turned out far better for diversified investors than had been feared when the pandemic hit triggering plunging share markets and deep recessions, with average balanced growth superannuation funds looking like they have returned around 3%. This followed around 15% last year. Balanced growth super funds returns have averaged around 7% p.a. over the last five years which is well above inflation & bank deposit returns. Read More..

2020 turned out far better for diversified investors than had been feared when the pandemic hit triggering plunging share markets and deep recessions, with average balanced growth superannuation funds looking like they have returned around 3%. This followed around 15% last year. Balanced growth super funds returns have averaged around 7% p.a. over the last five years which is well above inflation & bank deposit returns. Read More..

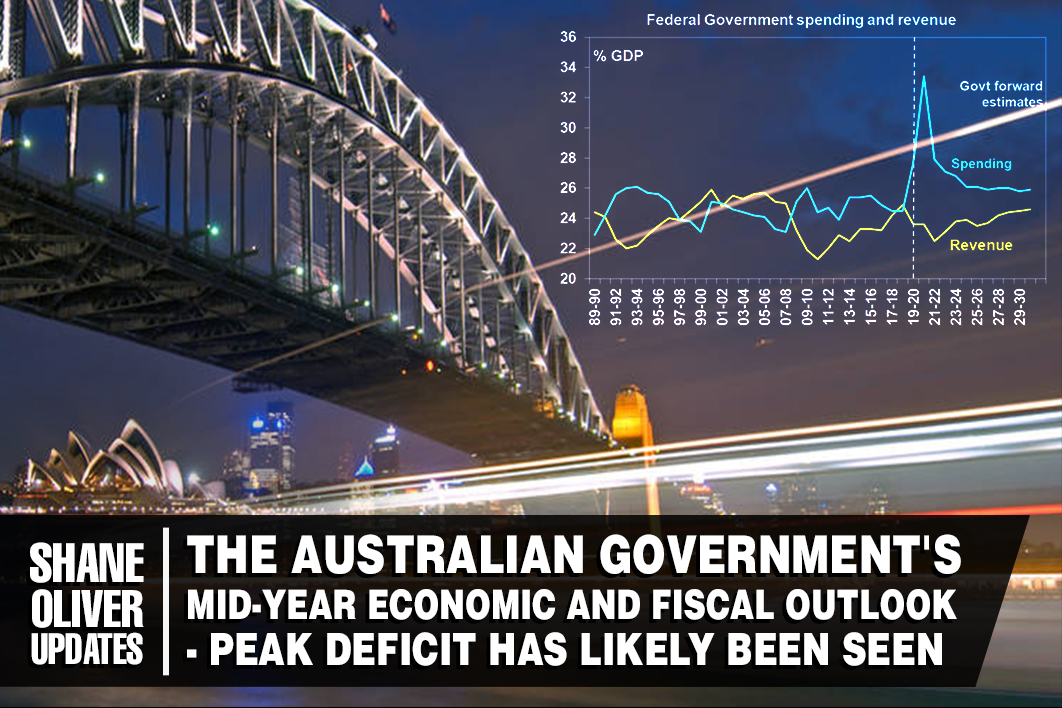

The Australian Government's Mid-Year Economic and Fiscal Outlook - peak deficit has likely been seen

21 December 2020

The Federal Government has updated its budget deficit projections and economic assumptions in the Mid-Year Economic and Fiscal Outlook (MYEFO). Thanks to a combination of stronger than expected economic growth and a higher than expected iron ore price, revenue growth has increased and projections for outlays have been lowered. Read More..

The Federal Government has updated its budget deficit projections and economic assumptions in the Mid-Year Economic and Fiscal Outlook (MYEFO). Thanks to a combination of stronger than expected economic growth and a higher than expected iron ore price, revenue growth has increased and projections for outlays have been lowered. Read More..

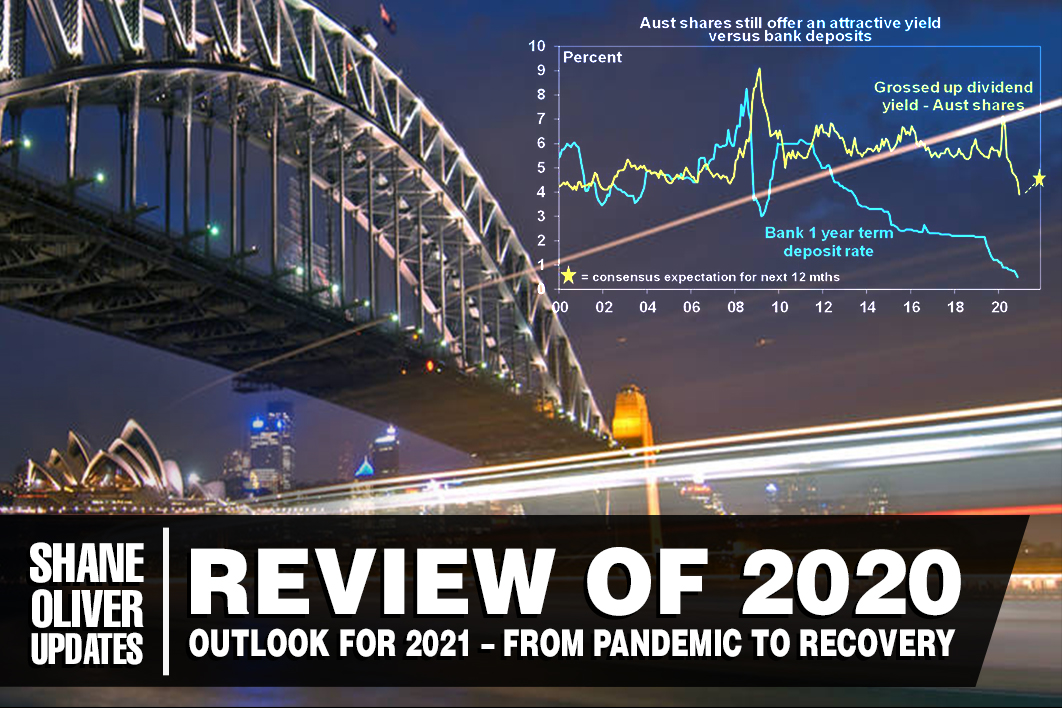

Shane Oliver Updates: Review Of 2020, Outlook For 2021 – From Pandemic To Recovery

9 December 2020

2020 didn’t exactly turn out the way I or many expected a year ago. For Australia, the year started badly as severe drought had given way to the worst bushfires on record. But just as the bushfires were receding it gave way to the coronavirus pandemic. Every year has a big surprise - or what Dr. Don Stammer has long called Factor X - but they don’t usually have such a profound impact as the coronavirus pandemic has. Read More..

2020 didn’t exactly turn out the way I or many expected a year ago. For Australia, the year started badly as severe drought had given way to the worst bushfires on record. But just as the bushfires were receding it gave way to the coronavirus pandemic. Every year has a big surprise - or what Dr. Don Stammer has long called Factor X - but they don’t usually have such a profound impact as the coronavirus pandemic has. Read More..

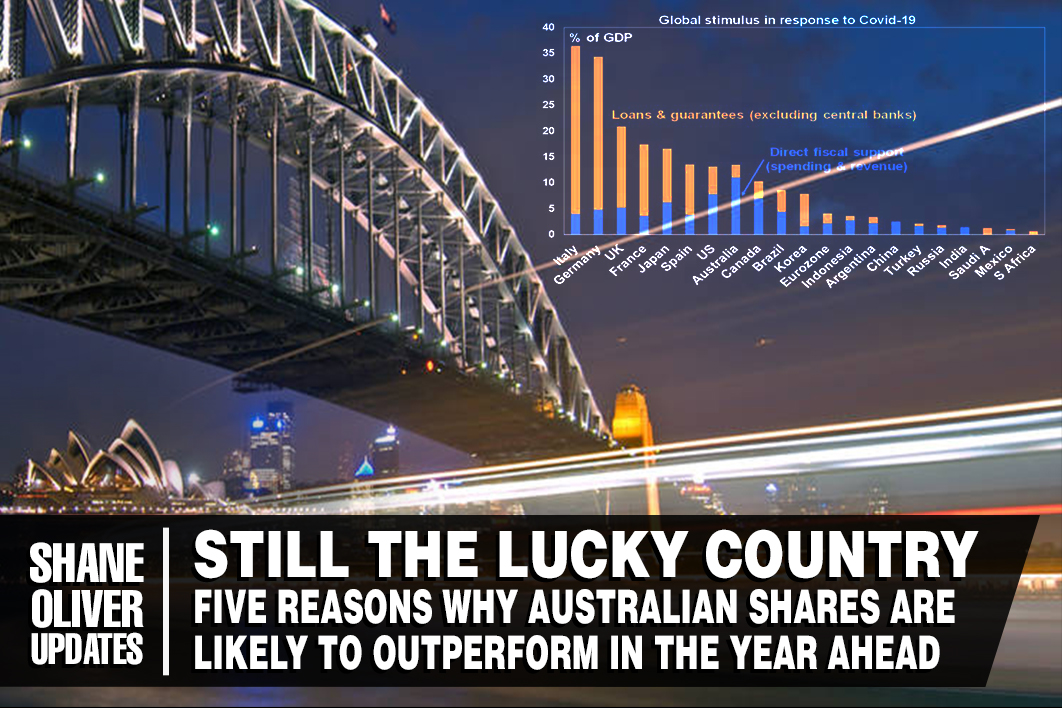

Shane Oliver Updates: Still The Lucky Country – Five Reasons Why Australian Shares Are Likely To Outperform In The Year Ahead

23 November 2020

Australia continues to perform better in “controlling” coronavirus, it has a stronger economic support policy response, its major trading partners in Asia are in better shape, the drag from the mining bust is over and it should benefit from a cyclical global recovery in 2021. Read More..

Australia continues to perform better in “controlling” coronavirus, it has a stronger economic support policy response, its major trading partners in Asia are in better shape, the drag from the mining bust is over and it should benefit from a cyclical global recovery in 2021. Read More..

Shane Oliver Updates: Mixed Outlook For Australian Housing Amid Prolonged Pandemic

6 November 2020

A relatively high rate of unemployment across the nation, coupled with a freeze on immigration, and consequently population growth, might ordinarily spell bad news for the housing market. Instead, Australian capital city average dwelling prices rose 0.2% in October, according to CoreLogic, the first monthly gain since April and hot on the heels of a cumulative contraction of almost 3% between April and September. Read More..

A relatively high rate of unemployment across the nation, coupled with a freeze on immigration, and consequently population growth, might ordinarily spell bad news for the housing market. Instead, Australian capital city average dwelling prices rose 0.2% in October, according to CoreLogic, the first monthly gain since April and hot on the heels of a cumulative contraction of almost 3% between April and September. Read More..

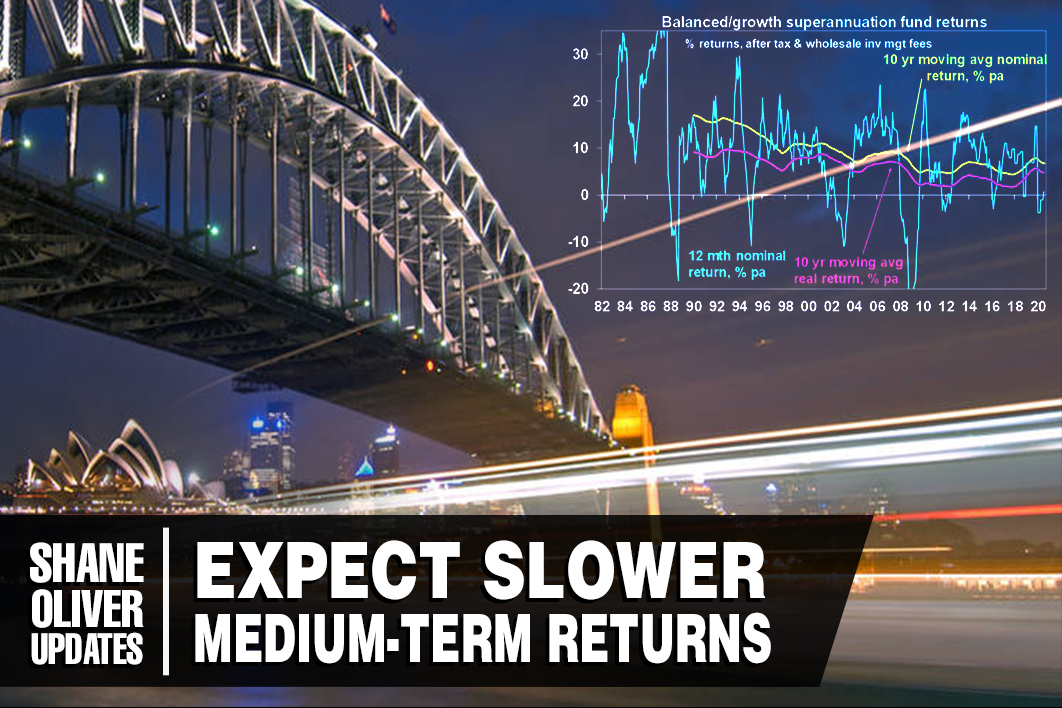

Shane Oliver Updates: Expect Slower Medium-Term Returns

22 October 2020

Despite a 35% or so plunge in share markets earlier this year; on the back of the pandemic and rough patches in 2018, 2015 and 2011, well diversified Australian investors have seen pretty good returns over the last 10 years. The median balanced growth superannuation fund returned 5.8% pa over the five years to August and 7.3% pa over 10 years and that’s after fees and taxes. Read More..

Despite a 35% or so plunge in share markets earlier this year; on the back of the pandemic and rough patches in 2018, 2015 and 2011, well diversified Australian investors have seen pretty good returns over the last 10 years. The median balanced growth superannuation fund returned 5.8% pa over the five years to August and 7.3% pa over 10 years and that’s after fees and taxes. Read More..

Federal Budget Update 2020-21

8 October 2020

Originally scheduled for release on 12 May 2020, the delayed Federal Budget was released at 7:30pm on 6 October 2020, the delay having resulted from Australia’s, and indeed the rest of the world’s health and economic attention being diverted to managing the Coronavirus pandemic, or COVID-19. Read More..

Originally scheduled for release on 12 May 2020, the delayed Federal Budget was released at 7:30pm on 6 October 2020, the delay having resulted from Australia’s, and indeed the rest of the world’s health and economic attention being diverted to managing the Coronavirus pandemic, or COVID-19. Read More..

2020 Federal Budget Analysis

7 October 2020

Treasurer Josh Frydenberg’s Budget provides tax relief and financial assistance for many Australians, including low and middle income earners, business owners, young workers and social security recipients. Read More..

Treasurer Josh Frydenberg’s Budget provides tax relief and financial assistance for many Australians, including low and middle income earners, business owners, young workers and social security recipients. Read More..

Shane Oliver Updates: Risks remain for global markets in an otherwise positive outlook

5 October 2020

Recent falls in global share markets have triggered talk in some quarters of a potential market crash, but investors should maintain some perspective, given the historical propensity for market corrections and seasonal weakness through the month of September. Read More..

Recent falls in global share markets have triggered talk in some quarters of a potential market crash, but investors should maintain some perspective, given the historical propensity for market corrections and seasonal weakness through the month of September. Read More..

Shane Oliver Updates: The Global GDP Picture: How Does Australia Stack Up?

1 October 2020

Australia’s 7% contraction in GDP during the June quarter was the largest since quarterly records began in 1959. Following on the back of a 0.3% dip in the March quarter, it brought a shattering end to almost three decades of growth without a recession, despite two significant global financial crises and the Asian/Emerging Market crisis in the interim. Read More..

Australia’s 7% contraction in GDP during the June quarter was the largest since quarterly records began in 1959. Following on the back of a 0.3% dip in the March quarter, it brought a shattering end to almost three decades of growth without a recession, despite two significant global financial crises and the Asian/Emerging Market crisis in the interim. Read More..

Shane Oliver Updates: Australia’s “Eye Popping” Budget Deficit And Public Debt Blow Out - Can It Be Paid Off? Does It Matter?

28 September 2020

Much concern has been expressed about the longer-term consequences of the blowout in budget deficits and public debt in response to the economic hit from coronavirus. This is understandable given their scale. In Australia, the Treasurer described the projected budget deficit for this financial year of $185bn as “eye watering”. Read More..

Much concern has been expressed about the longer-term consequences of the blowout in budget deficits and public debt in response to the economic hit from coronavirus. This is understandable given their scale. In Australia, the Treasurer described the projected budget deficit for this financial year of $185bn as “eye watering”. Read More..

Shane Oliver Updates: Market Outlook Q&A – Disconnect To Real Economy, Growth V Value, Vaccines, Property, Gold, Inflation And Other Issues

9 September 2020

In recently presenting a market outlook webinar we received lots of questions about the outlook but were unable to answer them all given time limitations. Here Shane Oliver tries to cover the main questions investors have in a simple Q&A format. Read More..

In recently presenting a market outlook webinar we received lots of questions about the outlook but were unable to answer them all given time limitations. Here Shane Oliver tries to cover the main questions investors have in a simple Q&A format. Read More..

Graeme Colley Updates On Self Managed Super Funds (SMSF): Changes To Age Limits On Contributions And The Work Test

3 September 2020

From 1 July 2020, the recent change in legislation has allowed making contributions to super easier for anyone aged 65 or 66 years of age as there now is no requirement to meet the work

From 1 July 2020, the recent change in legislation has allowed making contributions to super easier for anyone aged 65 or 66 years of age as there now is no requirement to meet the work